Sticks With Supply Chains Despite Pandemic Fallout from buzai232's blog

The coronavirus pandemic may change many things about the way French

car-parts maker Valeo SA operates, but its sprawling global supply

chains wont be among them.To get more news about WikiFX, you can visit wikifx news official website.

European leaders have talked of bringing manufacturing back to member countries to avoid the type of crises that quickly followed the initial outbreak in China. The shutdown of auto-parts factories there sent Europe‘s vehicle producers scrambling for replacements to feed assembly lines. Europe’s dependence on foreign-made health-care protective gear like masks and gowns also became painfully clear.

Yet for corporate leaders like Valeo Chief Executive Officer Jacques Aschenbroich, shortening logistics routes isnt part of his plan to extricate the maker of 8 million components a day from the deep industry slump that has pushed European car sales to record lows.

“Our final customers and auto-parts clients arent ready to pay more if our supply chains were relocated,” Aschenbroich said Sunday at the Aix-en-Seine economics conference in Paris. “So if neither of them put a value on the risk, there is no chance that supply chains will be relocated.”

Rather than put them under scrutiny, “we should pay homage to these supply chains that have showed extraordinary resilience after withstanding successive shocks like Fukushima, flooding in Thailand and now Covid-19,” Aschenbroich added.

In the wake of the global pandemic, which is causing the steepest recession in almost a century, the European Union has proposed a 750 billion-euro ($843 billion) recovery package that could aim to ensure “strategic autonomy” in key sectors and stronger value chains within the EU.

European Central Bank Executive Board Member Luis de Guindos and Dutch central bank Governor Klaas Knot have independently argued that companies should consider moving parts of their supply chains closer to home even if that meant higher costs.

At the weekend conference in Paris, ECB President Christine Lagarde said the crisis would lead to changes in manufacturing, with an estimated contraction of supply chains of about 35% and increase in industrial robotization of 70% to 75%.

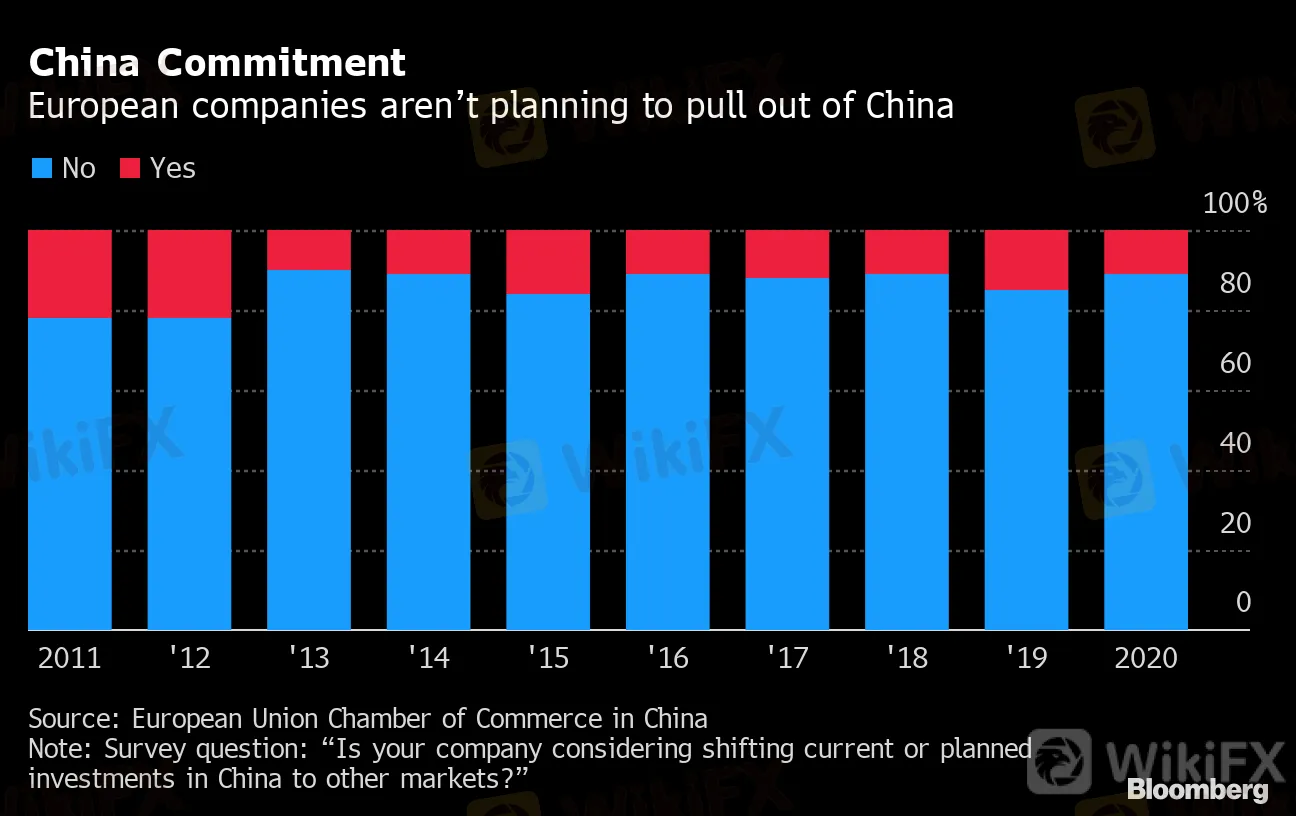

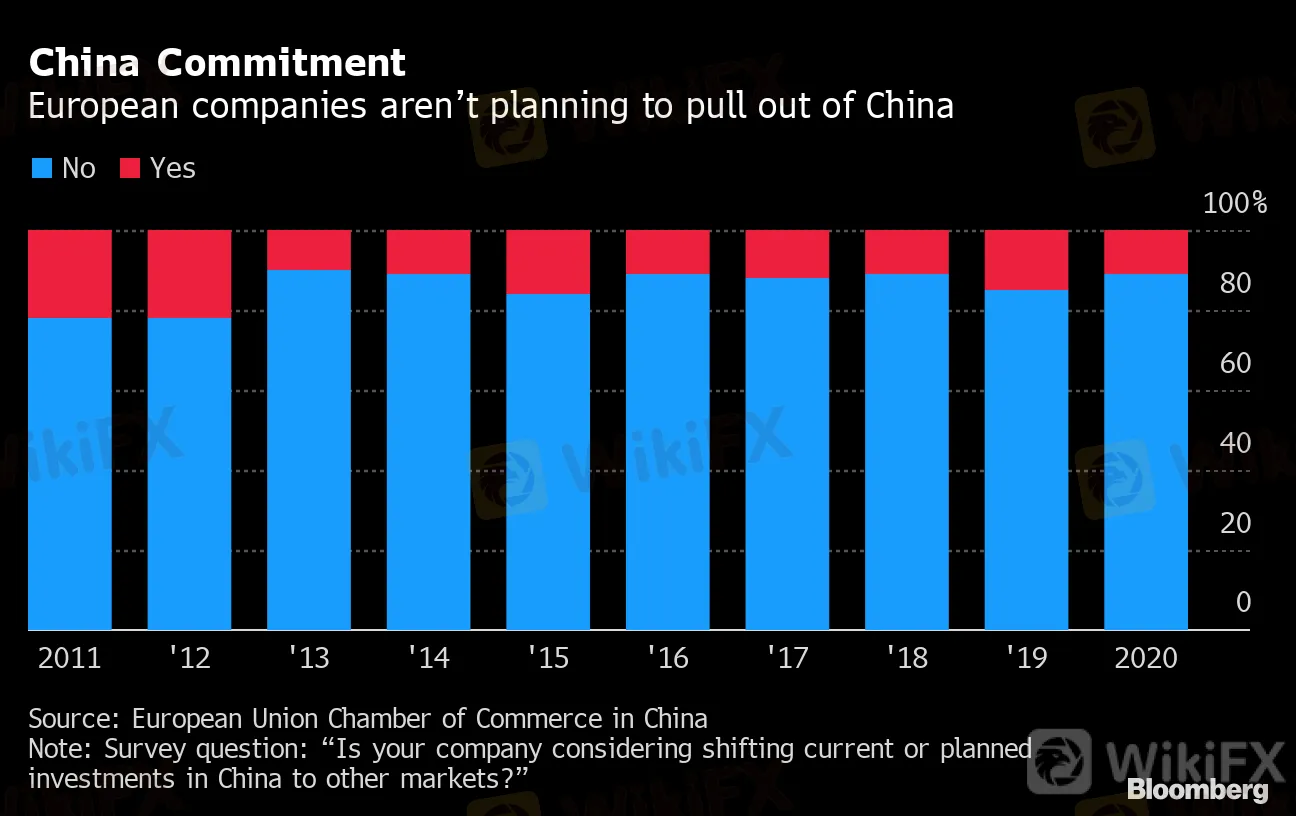

Evidence on the ground suggests a massive shift back to Europe is unlikely in the near-term because of the ever-growing importance of China and the difference in manufacturing costs.“I don‘t see a massive relocation,” Rodolphe Saade, CEO of CMA CGM SA, the world’s third-largest container shipping company, told the conference. While the transporter is seeing greater “intra-regional” volumes within Asia and Europe, he said consumers will “continue to buy televisions and other goods made in China because they are much cheaper to build than in France and elsewhere in Europe.”

To counter Asian dominance, politicians may have to resort to hard-charging policies and subsidies to convince companies to get on board, as was the case with electric-car batteries. France and Germany have pooled efforts to kick-start a European industry.

“Weve managed to build an agreement between governments -- France and Germany -- and companies to face the challenge together,” Patrick Pouyanne, head of Total SA, said Saturday at the conference. “It requires significant subsidies.”

“We‘ve decided that it was worth taking that risk,” he said of the oil giant’s participation in the project. “Why? Because one lesson for companies like us isnt relocation, but diversification of supply chains. We know about geopolitical risks, and the need to diversify.”

The political effort to bring industry home is particularly intense in France. New Prime Minister Jean Castex spent part of Saturday at a semiconductor company where he hammered home the need for more industries to relocate to safeguard jobs. French President Emmanuel Macron has tied roughly 8 billion euros in aid to the struggling auto industry to increasing domestic output.

“Industry has fled the country because we didnt take care of it,” said Eric Lombard, head of state-controlled financial institution Caisse des Dépôts et Consignations. “Last year, for the first time in 20 years, more factories opened than closed in France. This is the result of proactive measures.”

European leaders have talked of bringing manufacturing back to member countries to avoid the type of crises that quickly followed the initial outbreak in China. The shutdown of auto-parts factories there sent Europe‘s vehicle producers scrambling for replacements to feed assembly lines. Europe’s dependence on foreign-made health-care protective gear like masks and gowns also became painfully clear.

Yet for corporate leaders like Valeo Chief Executive Officer Jacques Aschenbroich, shortening logistics routes isnt part of his plan to extricate the maker of 8 million components a day from the deep industry slump that has pushed European car sales to record lows.

“Our final customers and auto-parts clients arent ready to pay more if our supply chains were relocated,” Aschenbroich said Sunday at the Aix-en-Seine economics conference in Paris. “So if neither of them put a value on the risk, there is no chance that supply chains will be relocated.”

Rather than put them under scrutiny, “we should pay homage to these supply chains that have showed extraordinary resilience after withstanding successive shocks like Fukushima, flooding in Thailand and now Covid-19,” Aschenbroich added.

In the wake of the global pandemic, which is causing the steepest recession in almost a century, the European Union has proposed a 750 billion-euro ($843 billion) recovery package that could aim to ensure “strategic autonomy” in key sectors and stronger value chains within the EU.

European Central Bank Executive Board Member Luis de Guindos and Dutch central bank Governor Klaas Knot have independently argued that companies should consider moving parts of their supply chains closer to home even if that meant higher costs.

At the weekend conference in Paris, ECB President Christine Lagarde said the crisis would lead to changes in manufacturing, with an estimated contraction of supply chains of about 35% and increase in industrial robotization of 70% to 75%.

Evidence on the ground suggests a massive shift back to Europe is unlikely in the near-term because of the ever-growing importance of China and the difference in manufacturing costs.“I don‘t see a massive relocation,” Rodolphe Saade, CEO of CMA CGM SA, the world’s third-largest container shipping company, told the conference. While the transporter is seeing greater “intra-regional” volumes within Asia and Europe, he said consumers will “continue to buy televisions and other goods made in China because they are much cheaper to build than in France and elsewhere in Europe.”

To counter Asian dominance, politicians may have to resort to hard-charging policies and subsidies to convince companies to get on board, as was the case with electric-car batteries. France and Germany have pooled efforts to kick-start a European industry.

“Weve managed to build an agreement between governments -- France and Germany -- and companies to face the challenge together,” Patrick Pouyanne, head of Total SA, said Saturday at the conference. “It requires significant subsidies.”

“We‘ve decided that it was worth taking that risk,” he said of the oil giant’s participation in the project. “Why? Because one lesson for companies like us isnt relocation, but diversification of supply chains. We know about geopolitical risks, and the need to diversify.”

The political effort to bring industry home is particularly intense in France. New Prime Minister Jean Castex spent part of Saturday at a semiconductor company where he hammered home the need for more industries to relocate to safeguard jobs. French President Emmanuel Macron has tied roughly 8 billion euros in aid to the struggling auto industry to increasing domestic output.

“Industry has fled the country because we didnt take care of it,” said Eric Lombard, head of state-controlled financial institution Caisse des Dépôts et Consignations. “Last year, for the first time in 20 years, more factories opened than closed in France. This is the result of proactive measures.”

Post

| By | buzai232 |

| Added | Jul 10 '20, 12:48AM |

Rate

Archives

- All

- December 2017

- November 2017

- October 2017

- September 2017

- June 2017

- May 2017

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- January 2020

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2024

- October 2024

- September 2024

- April 2024

The Wall