The e-bike conversion market quietly revs up in the wake of the e-bike boom from buzai232's blog

The e-bike conversion market quietly revs up in the wake of the e-bike boom

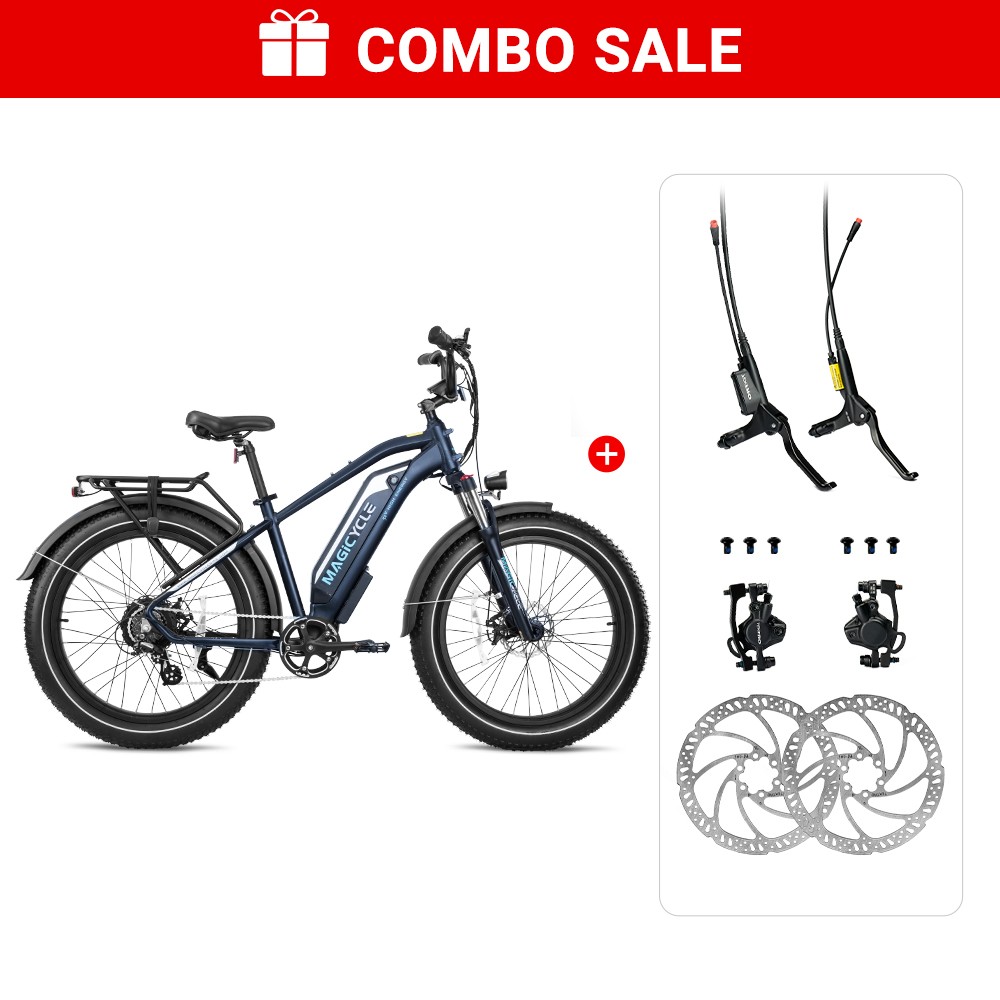

Shop owner Brad Davis’s career as an e-bike entrepreneur offers a peek inside an often overlooked but increasingly profitable corner of the electric bike market: e-bike conversions. To get more news about ebike for sale, you can visit magicyclebike.com official website.

A decade or more ago, before the industry pivoted and began pumping out e-bikes in all shapes, sizes, and price points, many e-bikes on American streets were DIY retrofits. Early adopters had to figure out how to install a motor and battery system themselves or find a shop to do it.To get more news about e bike, you can visit magicyclebike.com official website.

“There wasn’t anything good on the market,” said Davis, who saw an opportunity. Thirteen years ago, he co-founded EcoSpeed, an early e-bike conversion kit that never really took off. “The batteries all kind of sucked.”

Davis pulled the plug on EcoSpeed six years ago and opened Nomad Cycles, which specializes in converting existing bikes with aftermarket motors — mostly from Bafang. “Essentially, Bafang came out with their BBSHD system, and it was so good and so cheap that we just started buying theirs.”Multiple dealers and suppliers interviewed for this story said Bafang is the top motor supplier in the conversion market. “Bafang is the market leader for North America by far. They have their thumb on the conversion market,” said Adam Ostlund, co-founder of Electrify Bike Company in West Jordan, Utah. To get more news about electric bike, you can visit magicyclebike.com official website.

Other motor manufacturers supplying the domestic conversion market include Tongsheng — like Bafang, based in China — and CYC Motors out of Hong Kong. Promovec is a Danish brand that has opened a U.S. office with plans to begin selling conversion kits to dealers.

Other suppliers include smaller brands like Electric Bike Outfitters in Denver that source motors, battery cells and electronics from China and re-brand them for dealer and direct-to-consumer sales.

Electrify Bike Company, located in the greater Salt Lake City metro area, has expanded into multiple sales channels in recent years, offering conversion kits for sale to both dealers and consumers, doing conversions for walk-in customers and now opening a retail store to sell its own branded e-bikes. “We will build up existing bike brands and sell those as conversions,” said Ostlund.

Dealers say that price is a key factor in why consumers choose a conversion rather than a complete e-bike off a showroom floor. For the cost of a heavy, entry level e-bike, consumers who own a nice bike or frame can continue riding it with an electric conversion.

“A lot of people already own really nice bikes, but for a variety of reasons they can’t or don’t ride them anymore,” Ostlund said. “The motors we use for conversions are often the same motors used on pre-built e-bikes.” Reliable data on the size of the domestic e-bike conversion market is scant, but retailers and suppliers say sales are booming. Consultant and Light Electric Vehicle Association Chairman Ed Benjamin analyzed Customs import records to estimate that about 24,000 DIY kits entered the country last year.

Benjamin cautioned that this opaque market is challenging to track and his count may be low.

Asked to describe their customers’ demographics, dealers said they are often older individuals and retirees — the same consumers courted by e-bike brands.

Another customer base is individuals with physical challenges or injuries that need a trike or hand cycle or adaptive bike.

“You can save thousands of dollars” by converting an existing acoustic adaptive bike or trike, said Livingston, a mechanical engineer who founded EBO in 2015 after undergoing chemotherapy that scarred his lungs. He converted a bike to electric assist and found it helped his healing.

Post

| By | buzai232 |

| Added | Jul 22 '22, 06:55PM |

Tags

Rate

Archives

- All

- December 2017

- November 2017

- October 2017

- September 2017

- June 2017

- May 2017

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- January 2020

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2024

- October 2024

- September 2024

- April 2024

The Wall