AVATRADE REVIEW from buzai232's blog

AVATRADE REVIEW

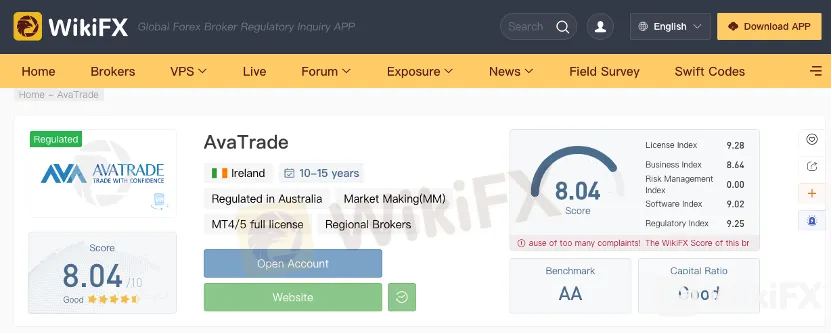

A fully regulated broker with a presence in Europe, South Africa, the Middle East, British Virgin Islands, Australia and Japan, Avatrade deals with mainly forex and CFDs on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in Dublin, Ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.To get more news about AvaTrade Pros & Cons, you can visit wikifx.com official website.

AvaTrade has been facilitating online trading since 2006 and has offices all over the world. But as with any brokerage (especially when dealing with forex!), you need to ensure your trades and investments are safe, fees and commissions are reasonable, and customer service is on point.

Who Uses AvaTrade?

AvaTrade caters to the needs of diverse client groups due to the options it provides in terms of its trading platforms/software and tradable asset classes.

Beginners. With the firm’s intuitive and simple interface and the solid backup provided by the AvaTrade’s customer support team, a beginner can easily and comfortably navigate through the complex investing world. The firm also provides specialized educational content for beginners to acquaint them with trading. A case in point is its “Trading for Beginners” section.

Advanced Traders. AvaTrade allows desktop, tablet, mobile and web-based trading with Meta Trader 4 and AvaTradeGO, which provide choices for advanced traders. It has a range of automated trading platforms and EA compatibility. The firm also conducts free webinars targeting traders at all levels.

Traders seeking well-diversified portfolios. The 250+ instruments in stocks, commodities, indexes, forex, CFDs and cryptos help traders diversify their portfolio and in turn mitigate the risk involved.

AvaTrade Commissions and Fees

Account opening requires a minimum deposit of $100 if the deposit is made through credit card or wire transfer. The minimum opening balance depends on the base currency of a client’s deposit.

For forex trading, Avatrade doesn’t charge any commission on any trade but is compensated through the bid-ask spread. If the spread is 3 pips on 1,000 units of a currency pair, then the compensation to the brokerage amounts to $0.30.

The firm also charges inactivity fees of $50 for 3 consecutive months of non-use. The inactivity fee will be deducted from the customer’s trading account. AvaTrade charges an administration fee of $100 after 12 consecutive months of non-use.

Research from AvaTrade

AvaTrade carries a wide range of educational tools in a webpage dedicated for education. It provides educational content for beginners, focusing on online trading forex, CFD, along with technical analysis. It also provides information on order types and economic indicators that impact currency market.

An ebook is available for download by clients. Online videos on topics such as advanced trading tools, beginner lessons, forex trading strategies, MetaTrader 4 for beginners, MetaTrader 4 Guide and MyAva guide are available for use.

AvaTrade has a dedicated website called “The Sharp Trader,” which provides all information a trader may need for trading. It has videos that explain various topics needed by traders with different levels of trading knowledge, daily technical and fundamental analysis by the firm’s market analyst, analytical videos and trading tools, including an economic calendar, trading platforms, calculators, etc.

Post

| By | buzai232 |

| Added | Aug 23 '22, 11:07PM |

Tags

Rate

Archives

- All

- December 2017

- November 2017

- October 2017

- September 2017

- June 2017

- May 2017

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- January 2020

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2024

- November 2024

- October 2024

- September 2024

- April 2024

The Wall