3 Pivot Point Forex Trading Strategies from buzai232's blog

3 Pivot Point Forex Trading Strategies

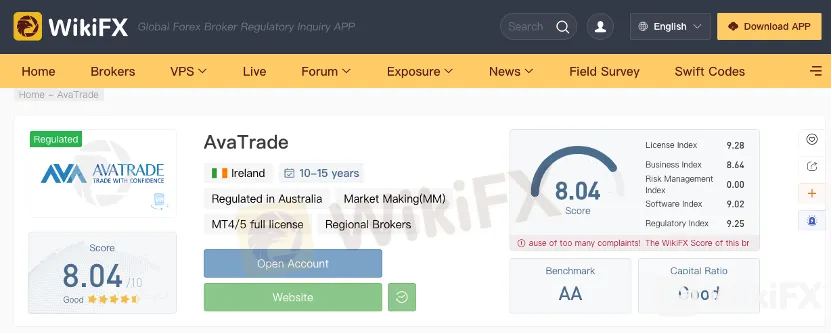

This article will provide you with a detailed explanation of the pivot point trading strategy. It will answer questions, such as: What are pivot points? What is a pivot point in share trading? What is a pivot point in Forex? How can you use support and resistance levels within a pivot point Indicator? What types of pivot points are there? How do you use pivot points? And how can pivot points be used in MetaTrader?To get more news about forex pivot point calculator, you can visit wikifx.com official website.

Pivot points represent the averages for the highs, the lows, and the closing prices that occur within a trading session or a trading day. Pivot Points are a type of indicator used for technical analysis, which provides the basis for determining market trends.

Underpinning nearly all forms of technical analysis are the core concepts of support and resistance. These can be thought of as levels that are expected to be key battlegrounds in the battle between bears and bulls. As the market approaches them, some traders expect the price to rebound.

Others might anticipate the chance of a breakout. Consequently, they are important prices because they signpost the chance of significant movement. Therefore, identifying where these levels lie is a very useful skill to develop.

Given the importance of support and resistance points, there follows a natural question: How do we calculate where to find these crucial price levels? There are a large number of methods that attempt to satisfy this query.

One popular technique used is looking at pivot points. Pivot point trading takes standard price information, such as highs, lows and closes, and uses this information to project possible support and resistance levels.

Free Live Trading Webinars with Admirals

If you're interested in learning more about the best trading indicators, the most popular strategies, the latest news, trends and developments in the markets and more, there's no better way to do it than with the Admirals FREE regular trading webinars.

Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinions on the latest developments in the live markets. Click the banner below to register for FREE trading webinars!

Here's what you need to know about different types of pivot points in Forex and stocks before you start using the pivot point Forex indicator: Many different types of pivot analysis exist. We will now explore how to calculate the pivot point in Forex behind different kinds of pivot points, namely; Standard Pivot Points, Fibonacci Pivot Points and DeMark Pivot Points.

Standard Pivot Points

How do you calculate pivot points in Forex with standard pivot points? The starting calculation for this pivot point formula is the arithmetic mean of the high ( H), the low (L) and the close (C) from the previous period. We call this our base pivot point, P.

Post

| By | buzai232 |

| Added | Feb 10 '23, 08:54PM |

Tags

Rate

Archives

- All

- December 2017

- November 2017

- October 2017

- September 2017

- June 2017

- May 2017

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- January 2020

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2024

- October 2024

- September 2024

- April 2024

The Wall