ICM Capital Review 2023: Is It Perfect FX Broker For You? from buzai232's blog

ICM Capital Review 2023: Is It Perfect FX Broker For You?

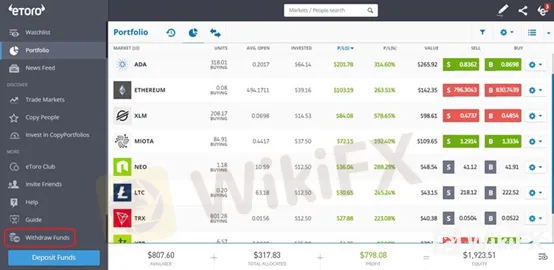

ICM Capital brokers is a reliable forex trading platform that gives traders access to various types of instruments like shares, cryptocurrencies, indices, CFDs, and many more across several financial markets. It helps its clients avoid high risk and make more money. The firm was established in 2009, and its head office is in the United Kingdom.To get more news about icm review, you can visit wikifx.com official website.

The firm concentrates on offering services to all kinds of clients, especially rich clients from the Middle East and North Africa. This has allowed ICM Capital to scoop many MENA awards. Though the firm accepts clients from every country across the globe, US clients are not allowed to trade at ICM Capital. It also has Fastest Growing Global Multi-Asset Broker Award given by Global Business Magazine Awards in 2022.

To review ICM Capital, the broker has a license from the CFTC and NFA, which makes it a safe place for forex trading. This ICM Capital Review delves deeper into the features, regulations, legitimacy, deposit and withdrawal fees and payment methods, and many other important functions. So, let's get started!

What Is ICM Capital?

ICM Capital Limited was established in 2009 and is headquartered in London, with the representative head office in the UAE. ICM Capital is registered under the Financial Conduct Authority (FCA), register number 520965.

ICM Capital Limited is a subsidiary firm of ICM Holding SARL along with ICM APAC, ICM Capital Limited Saint Vincent, and Mauritius. All these firms are within the ICM group and use the popular ICM.com branding.

Being one of the regulated brokers, ICM Capital offers trading services to traders across the globe. But, the management team, along with the CEO, has capitalized on, particularly the Mid-Eastern market, and won many awards there. Essentially, the foreign exchange broker launched its firm in Qatar in 2021, with its new office in the Qatar Financial Centre.

According to this ICM Capital Review, the company offers one of the best MetaTrader 4 forex platforms. The platform also offers customized ICM Direct and Zero exchange platforms. This combination of downloadable Direct and Zero trading platforms for various devices like Windows and Mac enables both beginners and advanced traders to trade using any device of their choice. ICM Capital offers minimum trades of 0.001 Lot and this is variable based on the type of account one opens. The maximum requirement for trades also varies based on ICM Capital trading tools, investment products, and also on the trader.

Negative Balance Protection

ICM Capital trading platform offers negative balance protection to protect users from the risk of losing money than deposited. This enables traders to trade safely.

Superior Execution of Deep Liquidity

ICM Direct account holders get to enjoy ECN technology. It provides them with direct market access, besides deep liquidity from the leading liquidity providers and Tier 1 banks.

Flexible Leverage

ICM Capital offers variable leveraged products that are in tune with the regulations of ESMA for ICM Capital retail accounts. Major currency pairs are leveraged at 30:1, gold, major indices, and non-major exotic forex pairs are leveraged at 20:1, other commodities are leveraged at 10:1, and reference values and individual equities are leveraged at 5:1. Clients with PRO accounts enjoy a max. leverage of 200:1 on foreign exchange pairs.

Post

| By | buzai232 |

| Added | Feb 19 '23, 10:16PM |

Tags

Rate

Archives

- All

- December 2017

- November 2017

- October 2017

- September 2017

- June 2017

- May 2017

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- January 2018

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- January 2020

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2024

- October 2024

- September 2024

- April 2024

The Wall