User blogs

FSC issues FAQs on Moneylending license

The Financial Services Commission (FSC) issued Frequently Asked Questions (FAQs) on the Moneylending (ML) license on 8 February 2023 in which it clarified the following:To get more news about obtain fsc license brokers, you can visit wikifx.com official website.

Only a company can apply for a ML license;

A Global Business Company (GBC) shall only apply for a ML license if it is engaging in moneylending activities in Mauritius i.e. a GBC which is involved only in moneylending activities outside of Mauritius or with other GBCs will not be required to apply for the ML license;

A holder of a Moneylending Licence shall be required to register with the Money Credit Information Bureau (MCIB) once the licence is granted by the FSC;

The minimum stated unimpaired capital for the holder of a ML License of MUR 30,000,000 (or its equivalent) or 5% of the Moneylender’s total liabilities or such other amount as the FSC may require.

It will be recalled that the ML License, which was previously regulated by the Bank of Mauritius was subsequently moved under the purview of the FSC in 2020.

Any persons, other than a bank or a non-bank deposit taking institution, whose business is that of lending money in Mauritius or who provides, advertises or holds himself out in any way as providing that business, whether or not he possesses or owns property or money derived from sources other than the lending of money, and whether or not he carries on the business as a principal or as an agent, will be required to apply for the ML license. Persons exempted from applying for the ML license include:

any person bona fide carrying on the business of banking or insurance or bona fide carrying on any business not having as its primary object the lending of money, in the course of which and for the purposes of which it lends money;

any body corporate, incorporated or expressly empowered, or any other person expressly empowered by any other enactment to lend money;

any organisation whose operations are of an international character and which is approved by the Minister of Financial Services, Good Governance and Institutional Reforms;

SCB warns against Forex multi-level marketing scam

The Securities Commission of The Bahamas (SCB) yesterday warned Bahamians against engaging in a risky, multi-level marketing scam which has become popular locally in recent months.To get more news about scb regulated forex brokers, you can visit wikifx.com official website.

In a notice, the SCB stated it is very concerned that members of the public are being solicited to join the foreign exchange market, or Forex.

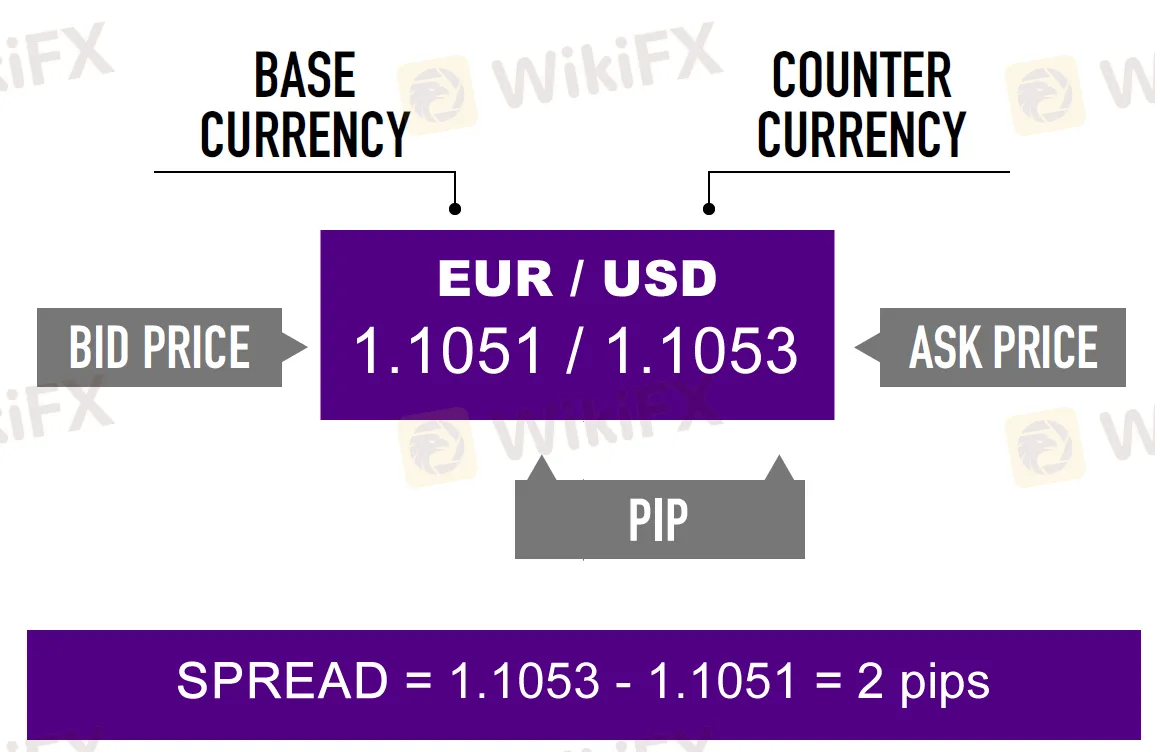

According to its website, trading on Forex involves “the buying of one currency and simultaneous selling of another” in which “traders attempt to profit by buying and selling currencies by actively speculating on the direction currencies are likely to take in the future”.

“There are various programs and/or schemes which are becoming increasingly popular in The Bahamas, as they are reportedly offering Forex training to the general public so that purportedly persons can ultimately engage in trading for themselves,” the SCB revealed yesterday.

“These entities are not in any way licensed or sanctioned by the commission. Individuals should be aware that Forex trading is a highly speculative activity that carries with it a significantly increased risk of financial loss. Those persons who engage in Forex trading solely for themselves should be aware that losses can go well beyond the amount of their initial investment.”

The SCB also noted that it is an offense for persons to trade in Forex for and on behalf of other persons without being registered by the commission.

“In light of the above mentioned, the commission is very concerned and advises the public to be aware of these unregistered individuals, or entities that are operating in or from within The Bahamas,” the notice states.

“Further, the commission urges the public not to engage, or continue any dealings, with these entities or related persons.”

Forex.com is a trading name of GAIN Global Markets Inc., which is authorized and regulated by the Cayman Islands Monetary Authority under the Securities Investment Business Law of the Cayman Islands, according to its website.

Best Forex Brokers in UK (FCA Regulated)

As the currency market is a decentralized entity, trading and processing of orders are carried out online. It is, therefore, necessary that you open an account with a broker that provides an online platform for trading forex. If you are a UK resident, then it is a good idea that you work with a forex broker that is based in the UK or at least has an office operating in the country. However, the problem is that there are a number of forex brokers out there in the market and identifying the right one to work with can be a challenging task, especially if you are new to forex trading.To get more news about fca regulated forex brokers, you can visit wikifx.com official website.

This is where our services can be of great help to you. We have analyzed and reviewed the operations of some of the major brokers that provide the forex trading platform in the UK on the basis of certain specific criteria listed below in order to make things easier for you. You can use this as the starting point of your research. You don’t have waste your precious time or hard earned money in order to evaluate hundreds of brokers operating in the country. You just have to find out as to which of the forex brokers listed in our site are best suited to your needs and do further research to make sure that you are making the right choice.

Regulation by a local authority is one of the key aspects you need to look for when identifying the best forex brokers in the UK. The main regulatory authority in England is the Financial Conduct Authority (FCA). The FCA is the regulator for the industries in the financial services sector in the country. When reviewing the forex brokers operating in the country we have taken this aspect into consideration.

This is definitely not an exhaustive list of things that you should look into when choosing the best forex broker in the UK. There are a few other aspects as well. These include customizations options, order entry types, automated trading options, trading alerts, strategy builders and backtesting options, among others. Further, it is better to look for brokers that offer free demo accounts so that you can try out their platforms prior to opening an account and funding it.

FXOpen UK, a popular metatrader ecn forex broker in the UK, offers several helpful features on their platform including expert advisors, technical analysis tools, indicators and professional graphics. Founded in 2013 and headquartered in the London UK, FXOpen is authorised and regulated by the Financial Conduct Authority under FCA firm reference number 579202. FX OPEN UK accepts Traders with Minimum deposit required to start trading on their platform is $300 and the minimum lot size offered by the broker is 0.01. The forex broker offers leverage up to 500:1 and makes available floating spreads starting from 0 pips. When it comes to trading platforms, FXOpen offers a wide range of platforms including MetaTrader 4, WebTrader and Mobile Trading Platform. As regards transfer of funds, options available with FXOpen include Wire transfer, credit/debit cards, Neteller and Skrill Moneybookers, Payza and Webmoney.

The online forex broker Plus500 UK Ltd is authorized as well as regulated by the Financial Conduct Authority. The forex broker services both institutional customers and retail investors and offers No Dealing Desk currency trading facility. PLUS500 UK which has its headquarters located in the UK was founded in 2008. Traders have to deposit a minimum of €100 if they want to use the broker’s platform for trading forex. The minimum position size offered by the company 0.01 and the leverage that traders can avail is 294:1. Spreads can be as low as 0.01%” (0.01% = spread for EUR/USD). Plus500 offers multiple trading platforms such as Windows Trader, WebTrader, Windows 10, Android App, Windows Phone App & iPhone App/iPad App/Apple Watch App. Payment options offered by the forex broker include Credit Card, PayPal, Wire Transfer, Skrill MoneyBookers.

XM, an online currency trading platform provider, was founded in 2009. The forex broker offers MetaTrader trading platform and more than 100 instruments from asset classes such as currencies, CFDs on stocks and precious metals. XM which serves both institutional as well as retail customers in more than 196 countries has established over 4 offices around the world. Traders who open accounts on their platform will have to deposit a minimum of $5 in order to start trading. While the minimum position size offered is 0.01, the leverage can go up to 888:1. XeMarkets is regulated broker by ASIC Australia, CySEC, FCA (UK), BaFin. XM broker offers low spreads From 1 Pips. Multiple forex platforms offered by the broker include MetaTrader 4, and Web, iPhone/iPad and mobile trader. When it comes to payments, options include Credit/ Debit Card, bank wire transfer, local bank transfer, Neteller, Moneybookers Skrill, Western Union, MoneyGram, WebMoney, China UnionPay, SOFORT, iDEAL.

1. Guaranteed credibility

All Forex brokers that are regulated by the Financial conduct authority (FCA) are required to submit financial reports to the regulatory body. This body scrutinizes the reports to make sure they are in line with set policies for secure and efficient Forex trading. This, therefore, means that regulated brokers are always credible since they are monitored. Also, another role of FCA is to fairly resolve disputes between Forex traders and brokers. So, trading with FCA UK forex brokers means that you are protected in case any disputes arise between you and your Forex broker.

2. Ensure investors’ money is safe

According to the FCA rules, FCA UK forex brokerage firms must keep their funds separate from the investors’ money. Keeping investors funds in a different account ensures that the brokerage firm cannot use the clients’ funds to cover any of its expenses.

Having segregated accounts safeguards the investors’ money in case of a financial crisis or bankruptcy. In such scenarios, the broker cannot use your money to pay its creditors. The FCA requires that the broker compensates the investor first. So when working with a regulated broker you are guaranteed safety for your money despite any financial situation the broker might face.

Given the uncertain financial conditions, you have to be sure your money is always safe. FCA has got you covered! Time and again, the regulatory body reviews all the FCA UK forex brokerage firms to ensure they maintain separate accounts for investors and the firm to keep your money protected from uncertain market conditions.

3. Enhances the chances of making profits for investors

It is usually easier to trade and make profits with FCA UK forex brokers than unregulated brokers. FCA monitors all regulated brokers to ensure they provide the right tools to make Forex trading simpler for the investors. It does this by ensuring the software used by brokers for trading meets the traders’ needs.

In addition, it ensures that Forex traders have access to the right information and support from the brokers. The FCA UK forex brokers should be able to answer the investors’ questions and provide help in case of any difficulties. This is in a bid to make Forex trading easy and profitable to the traders.

Overview of Japanese and Chinese Equity Index Futures Markets

On September 7, 2022, Japan Exchange Group (JPX) and China Financial Futures Exchange (CFFEX) signed an MOU to enhance their cooperation on the development of both derivatives markets.To get more news about cffex regulated forex brokers, you can visit wikifx.com official website.

This article will take the opportunity to introduce a brief market overview of the equity index futures listed at Osaka Exchange (OSE) under JPX and CFFEX.China and Japan have the second and third largest economies in the world in terms of GDP, so their sizable equities markets also have a significant presence. The market capitalization of the Chinese and Japanese equities markets at the end of 2021 was RMB 91 trillion (equivalent to around USD 14.4 trillion) and JPY 753 trillion (equivalent to around USD 6.5 trillion), respectively.

In addition to these cash-equities markets, both countries have active listed equities derivatives markets. The table below shows the types of the equity index futures listed at JPX and CFFEX.

As of December 2022, JPX has 16 listed equity index futures, underlying Japanese, overseas, REITs, and other indices, while CFFEX has 4 Chinese equity index futures.

In Japan, trading of Nikkei 225 Futures, the most popular listed equity index futures, and TOPIX Futures, a wide used product among institutional investors for hedging purposes, began in 1988.

Since then, JPX has expanded its product lineup and improved its trading rules and sophisticated trading systems to meet the demands of various players, including retail and domestic and overseas investors. JPX’s initiatives that have had a particularly significant impact on market expansion include:

Mini-sized contract futures, Nikkei 225 mini, were launched in 2006. Many Japanese retail investors rushed to equities and derivatives markets in the early 2000s, and the mini-sized products captured their trading demands.

A new derivatives trading system, J-GATE, was introduced in 2011 and upgraded in 2016 and 2021. This state-of-the-art trading system was developed by NASDAQ, providing market services at an international standard level for various investors, including HFTs.

The night trading session was introduced in 2007, and trading hours were extended until 8.00 pm in 2008, 11.30 pm in 2010, 3.00 am in 2011, 5.30 am in 2016, and 6 am in 2021. These changes provided further trading opportunities with overseas investors. In addition, JPX introduced holiday trading for derivatives markets in September 2022.

In China, the first equity index futures, CSI 300 Index Futures, were launched in April 2010, followed by SSE 50 Index Futures and CSI 500 Index Futures in April 2015, and CSI 1000 Index Futures in July 2022.

Upholding high standards with a focus on market stability, CFFEX strives to expand its financial derivatives product lineup to meet market participants’ diversified risk management demands. CFFEX’s chief efforts for market development are:

CFFEX has expanded market access for various types of investors. Over the years, CFFEX has witnessed a steady growth in institutional participation by catering to institutional investors’ hedging and investment needs.

CFFEX endeavors to steadily advance market opening-up, including catering to QFIIs/RQFIIs’ increasing needs to trade equity index futures for risk management purposes.

In consideration of global best practices and domestic market dynamics, CFFEX continues to improve its access channels, trading mechanisms, and risk control measures to ensure orderly market operations and safeguard transparency, fairness, and impartiality.

CFFEX has improved its IT infrastructure and data services. For example, CFFEX has secured three data centers to ensure continuous business operations: a primary data center, a same-city disaster recovery center and a remote disaster recovery center.

Trends in Trading Volume and Open Interests

JPX’s annual trading volume of equity index futures expanded to 338 million contracts in 2022, compared to just 13 million in 2000. Though the monthly trading volume fluctuated between 10 million and 20 million contracts, trading volume was recorded at its highest level in several decades in March 2020 due to market turbulence caused by the COVID-19 pandemic. In contrast, the open interest showed no remarkable trends, moving between a range of 1.5 million and 2.5 million contracts.