User blogs

Vital Markets Review

Vital Markets is an online trading platform. You can invest in various financial markets. Before investing, traders consider several factors. As you read this impartial review on Vital Markets, you come across red flags. Traders can benefit from stocks, crypto, and commodities trading, among other assets. To get more news about vital markets, you can visit wikifx.com official website.

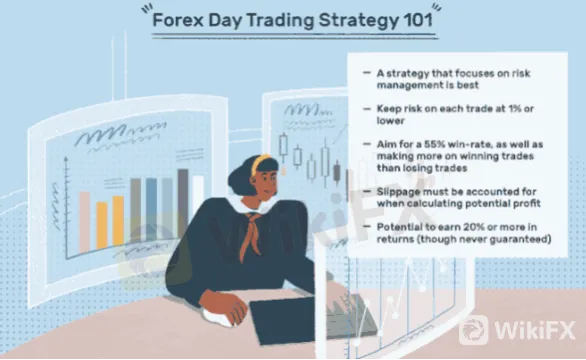

Vital Markets provides customers with more than just a trading account. Investing in the various financial markets is no Child’s play. Awful strategies guarantee awry results. There is no such thing as constant returns.

You encounter losing results when making trading decisions. You can limit losses by setting up Stop-loss among convenient respiration. The Investment firm does not have any protection against losing outcomes. Price actions and inflation, among other factors, affect price patterns. Social trading is not the most convenient trading approach to apply.

The returns profiting the account managers do not necessarily benefit when trading similar patterns. The investment firm’s promises to traders are insensible. Vital Markets immediately requires you to sign up. The registration processes need you to share personal information and connect wallets.

Vitalmarkets.com aims to achieve fast investment executions. You expect state-of-the-art technology and services. Automated trading is preferable to humans due to non-emotional mix-ups with trading directions. It’s best to stay cautious when selecting trading tools. Fraudsters guarantee state-of-the-art technology as well.

The kind of algorithm its software uses to stand out from competitors is unknown. Vital Markets looks to deliver trading services to all sorts of customers. Beginners require helpful academic tools to understand market operations. Scammers often present primary data explaining trade terms. You can access similar data online for no extra cost.

Vital Markets features cryptocurrency exchange. The niche experiences bearish and bullish market runs. With the proper academic knowledge, you can take reliable action during the dip. Vital Markets is on a mission to meet all traders’ needs. The traffic it attracts is minimal to verify the relevance of the same data. Traders get to copy directions from alleged experts.

Social trading is not the most convenient approach. Volatile market conditions affect the changes in price patterns. Hence trading the account manager’s directions does not guarantee results. Price action and inflation are factors leading to sudden market shifts.

Vital Markets Accounts and Trading Conditions

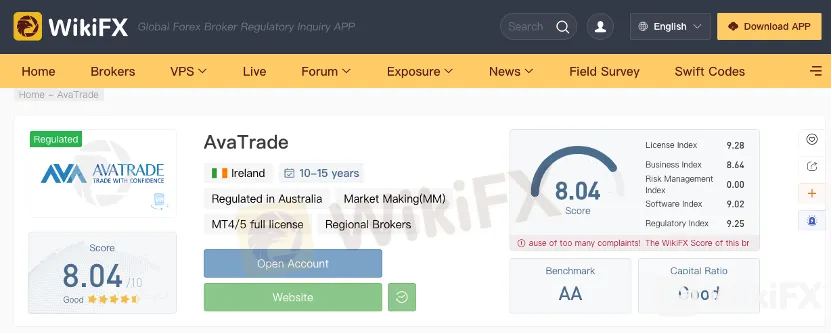

Vital Markets includes micro, Ecn and 0% commission among various plans. Scammers feature numerous accounts. Additionally, there is no reason to consider investing more money in the platform. Its trading conditions are unbearable.

The software available for investment is not compatible with MetaTrader. MetaTrader is reliable. You gain access to charting tools, automated trading and various investment apps. Relying on any web trading platform exposes you to malicious third-party attacks.

Vital Markets has no evidence of trade activities taking place. The investment firm is likely making adverse outcomes. Posting similar information lures investors away from its operations. Trade history for a couple of months helps determine results. It guarantees low rates and effective trading costs. Additionally, you sign up with fraudsters to only experience yielding returns.

Dominion Voting attorney calls out Fox for missing evidence in defamation

Dominion Voting Systems is calling out Fox News and its parent company, Fox Corp

, for failing to turn over evidence, with less than two months before the companies are set to go to trial over a defamation lawsuit.To get more news about dominion, you can visit wikifx.com official website.

On Wednesday, attorneys for Dominion and Fox met before a Delaware Superior Court judge to discuss scheduling for upcoming checkpoints.However, an attorney for Dominion said they are concerned that some evidence – such as certain board meeting minutes and the results of searches of personal drives – has yet to be produced by Fox and its cable TV networks. While this issue was already raised in July and January, the Dominion attorney said Wednesday they are still missing documents.

“We have not gotten anything. We pointed out categories of missing documents for both Fox News and Fox Corp that are still missing. And we are not talking about a document slipping through ... we are talking about categories of documents,” said Dominion attorney Justin Nelson on Wednesday.

Nelson said Dominion’s attorneys had been assured that Fox’s legal team would “ask the hard questions about missing documents so that we didn’t have to do it and engage in further discovery practice.”And that just hasn’t happened,” Nelson said, “and I understand why because they can’t do it.”

Fox attorney Dan Webb, a veteran trial attorney added to Fox’s roster last year, said he disagreed with much of what Nelson said during the hearing Wednesday.

“The parties are having problems on both sides,” Webb said Wednesday. “I think 70,000 documents were recently produced on damages, which is a huge issue in this case, that were late produced.”

Dominion brought the defamation lawsuit against Fox and its right-wing cable news networks, Fox News and Fox Business, seeking $1.6 billion in damages. It argues the networks and their anchors made false claims that Dominion’s voting machines rigged the results of the 2020 election.

Both attorneys acknowledged that Fox sent a letter to the special master Tuesday night regarding the matter. The Delaware judge on Wednesday didn’t weigh in further.

Dominion’s attorney Nelson refuted any issues Fox raised about Dominion’s production of documents in the case. “As best as I can tell, Dominion has still produced more documents than Fox in this case,” Nelson said.

In recent months, Fox Corp executives including Chairman Rupert Murdoch and his son and Fox CEO Lachlan Murdoch have faced questioning as part of the lawsuit.Hannity reportedly admitted he didn’t believe Dominion cheated Republican Donald Trump in the 2020 election, which Democrat Joe Biden won. The reported statements differ from the claims made on Hannity’s show following the election.

Documents and depositions have otherwise remained private. The New York Times recently requested that the documents in the case be unsealed.

Fox has vigorously denied the claims in the lawsuit that is being watched closely by First Amendment watchdogs and experts. Libel lawsuits are typically centered around one falsehood. But in this case Dominion cites a lengthy list of examples of Fox TV hosts making false claims even after they were shown to be untrue. Media companies are often broadly protected by the First Amendment.

Fox’s calls to dismiss the case have been denied by the court. A trial is slated to begin April 17. Neither side has shown signs of entering settlement talks. Dominion’s attorney said Wednesday the legal team, which had hoped for an earlier trial date, doesn’t want it moved any later despite the issue with evidence production.

INFINOX launches flagship all-in-one trading platform IX One

Global trading platform INFINOX has launched its all-in-one multi-asset trading platform IX One. The user-friendly and fully-customisable platform is packed with essential tools and analysis for traders of any experience.Further, to enhance user experience, the fully customisable platform comes with over 40 widgets that traders can use to create their own personal trader dashboard. Widgets include:To get more news about infinox, you can visit wikifx.com official website.

These features are available to traders on both mobile and web platforms, where they can trade FX, indices, crypto, equities and more. Accessing the platform is easy as well - the single-step login ensures that traders can get speedy access to the platform.

Furthermore, other popular INFINOX products such as IX Social copy trading are also integrated into the IX One platform.

Adam Saward, Executive Manager and driving force behind IX One said,

"Clients are always looking for more from their broker, and we're extremely proud of INFINOX's ability to recognise this demand and meet it from both a technology and a service point of view."

"With IX One, we've achieved an end-to-end destination for the complete trading experience. The platform packs in trading execution with cutting-edge tools and functionalities, so that traders never have to leave the platform - everything they need is on IX One," Saward added. "We're confident that with the combination of the IX One platform and two of our award winning offerings - trade execution & customer service - we'll be able to provide clients with a compelling trading experience. It's an exciting next step for INFINOX, and we're looking forward to building on this progress throughout the year."

3 Pivot Point Forex Trading Strategies

This article will provide you with a detailed explanation of the pivot point trading strategy. It will answer questions, such as: What are pivot points? What is a pivot point in share trading? What is a pivot point in Forex? How can you use support and resistance levels within a pivot point Indicator? What types of pivot points are there? How do you use pivot points? And how can pivot points be used in MetaTrader?To get more news about forex pivot point calculator, you can visit wikifx.com official website.

Pivot points represent the averages for the highs, the lows, and the closing prices that occur within a trading session or a trading day. Pivot Points are a type of indicator used for technical analysis, which provides the basis for determining market trends.

Underpinning nearly all forms of technical analysis are the core concepts of support and resistance. These can be thought of as levels that are expected to be key battlegrounds in the battle between bears and bulls. As the market approaches them, some traders expect the price to rebound.

Others might anticipate the chance of a breakout. Consequently, they are important prices because they signpost the chance of significant movement. Therefore, identifying where these levels lie is a very useful skill to develop.

Given the importance of support and resistance points, there follows a natural question: How do we calculate where to find these crucial price levels? There are a large number of methods that attempt to satisfy this query.

One popular technique used is looking at pivot points. Pivot point trading takes standard price information, such as highs, lows and closes, and uses this information to project possible support and resistance levels.

Free Live Trading Webinars with Admirals

If you're interested in learning more about the best trading indicators, the most popular strategies, the latest news, trends and developments in the markets and more, there's no better way to do it than with the Admirals FREE regular trading webinars.

Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinions on the latest developments in the live markets. Click the banner below to register for FREE trading webinars!

Here's what you need to know about different types of pivot points in Forex and stocks before you start using the pivot point Forex indicator: Many different types of pivot analysis exist. We will now explore how to calculate the pivot point in Forex behind different kinds of pivot points, namely; Standard Pivot Points, Fibonacci Pivot Points and DeMark Pivot Points.

Standard Pivot Points

How do you calculate pivot points in Forex with standard pivot points? The starting calculation for this pivot point formula is the arithmetic mean of the high ( H), the low (L) and the close (C) from the previous period. We call this our base pivot point, P.

What is a Forex Profit Calculator?

A forex profit calculator is a tool developed to help forex traders calculate their potential profits and losses depending on the outcome of the trade. The forex profit calculator is used by most FX traders to help them trade the foreign exchange markets.To get more news about forex profit calculator, you can visit wikifx.com official website.

A forex profit calculator takes the difference between a trader’s entry and exit prices and multiplies it based on the price interest point (pip) value of the trade. In addition to the opening and closing price of the trade, a forex profit calculator takes into account the currency pair traded, the lot size and the trader’s account base currency.

When using a forex calculator, it will usually ask you to input details such as the currency pair you are trading, the account currency, your trade size, the trade’s opening and closing price and whether you went long or short. From those inputs, it tells you the potential profit or loss for that trade.

Why Should Forex Traders Use a Profit Calculator?

Forex traders should use a forex calculator to take advantage of several benefits.

It allows the trader to make faster decisions, which are essential for adroitly getting in and out of positions in intraday forex trading. Success as a forex trader depends on a combination of skill, risk mitigation, appropriate position sizing and a lack of emotional decision-making.

Tools like a forex calculator help traders calculate and set the appropriate risk/reward ratio, which is important for risk management and long-term trading success. Traders can use it to calculate take-profit or stop-loss levels.

Another tool, the forex swap calculator, shows traders the amount of rollover they will receive or pay on a daily basis depending on the interest rate differentials between the two currencies traded.

This type of calculator is useful for carry traders, allowing them to estimate potential earnings and preplan the trades they want to take. Forex traders can use this calculator to help reduce fees and understand the pairs that have the highest interest expenses. A trader may decide to hold a particular position for only a day instead of two or more days based on the fact that the carry charges, as shown by the swap calculator, are high compared to other pairs.

How is Profit Calculated in Forex Trading?

The method of calculating profit and loss (P&L) from forex trading is simple. All you need is the position size and the number of pips the pair has moved to calculate the P&L of a position. The position size multiplied by the pip movement equals the profit or loss made.The forex profit calculator takes into account the difference between the entry and exit prices and multiplies it based on the pip value of your trade. The pip value calculation assesses the currency pair, the lot size and the base currency. Once those details have been added to the calculator, you see the profit or loss of the trade.

Paris maintains its rankings in FX and rate derivatives markets

Foreign exchange and financial derivatives markets are concentrated in a few financial centres. Every three years, the Triennial Survey coordinated by the BIS and conducted by the Banque de France for France, provides an overview of the global landscape.To get more news about forex global rankings, you can visit wikifx.com official website.

London and the United States continue to top the rankings. Forex activity volumes there are respectively four and two times higher than in the next biggest financial centre (and respectively eight and five times higher for interest rate derivatives). However, activity volumes in London have levelled off in the forex market since 2019 and fallen sharply in interest rate derivatives, whereas rival European centres have seen double-digit growth and have gained market share in both activities.

Whereas Singapore and Hong Kong were jostling for 3rd place in the forex market in 2019, Singapore now ranks well ahead of Hong Kong. The Singapore dollar has expanded its market share from 1.8% to 2.4% of daily global trading volumes, and now stands level with the Hong Kong dollar which in turn has seen a sharp fall in market share. Nevertheless, Singapore continues to lag behind Hong Kong in the interest rate derivatives market.

In the rest of Asia, Japan remains one of the top five centres for forex transactions, but has fallen one place in the rankings for interest rate derivatives. China has remained stable versus 2019 in the forex market at 10th place. Both countries may have been negatively affected by the prolonged maintenance of public health restrictions during the pandemic.

There are also a few standout centres that have seen particularly strong improvements in their rankings: this is notably the case for Germany in interest rate derivatives and Canada in the forex market.

Global forex market activity has risen by 19% in the past three years (gross data adjusted for domestic double counting). This strong growth comes against a backdrop of rising global tensions and the appreciation of the US dollar since the summer of 2021. With a daily volume of USD 214 billion of transactions, compared with USD 167 billion in 2019, the Paris financial centre has expanded in line with global markets, while at the same time maintaining its No. 7 ranking, ahead of Germany.

In Paris, activity is highly concentrated among just a few players: four entities account for over 70% of total market activity. They have a strong presence in FX swaps, which is their preferred instrument for managing their cash reserves and hedging their forex risk. France stands out from the rest of the world in this respect: FX swaps are used in 71% of transactions in France compared with an average of 51% globally.

In France and the rest of the world, transaction maturities are becoming shorter: 80% have a maturity of up to one month compared with 77% in 2019 (global average of 84% in 2022). The rise in very short term transactions in part explains the growth in global activity, as contracts are mechanically renewed more often.

Brexit, which has led several French and foreign institutions to shift large account management activities out of London, has also helped to boost activity volumes in Paris by increasing the number of staff based in France.

Are U.S. News undergraduate rankings at risk with the exodus of law schools?

In 2007, a collective of liberal arts colleges known as the Annapolis Group convened in Maryland’s capital and decided to take a jab at one of the more powerful forces in admissions: U.S. News & World Report’s yearly rankings.To get more news about undergraduate, you can visit wikifx.com official website.

The colleges’ presidents said they would no longer participate in the list. Given higher education’s follow-the-leader tendency, they hoped other institutions would abandon the rankings, which are often criticized for relying on flawed methodology and hurting equity efforts.An exodus never materialized. But 15 years later, observers see cracks in the foundation of U.S. News’ system due to bombshell announcements last month that several high-profile law schools — including those at Yale, Harvard and Columbia universities — would no longer send the publication the data it uses to construct the rankings.

Not since the Annapolis Group’s plan has there been such a deliberate, college-led strike against rankings, said Colin Diver. At the time of the gathering, Diver was president of one of the liberal arts institutions, but one that had sworn off the rankings long before — Reed College, in Oregon.

The law schools’ abandonment has raised a question: Will a similar campaign emerge against U.S. News’ bread-and-butter product — the Best Colleges undergraduate rankings?Experts view the law schools’ decisions not as an immediate death sentence for the rankings, but rather a part of incremental change, like potentially empowering colleges to force U.S. News to rework metrics they find most objectionable.

Others feel society prizes rankings in general so much that they could never be dislodged from the higher ed landscape. Consumers appreciate easy lists — something that tells them the right skin product or phone to purchase.

Rankings are one thing for comparable products that cost $15 or $50, or even for more expensive goods that can later be sold like cars. But colleges’ varying missions and value propositions cannot be summed up as easily as which toaster to buy.U.S. News & World Report published its first college rankings in 1983, carving out a new niche. The public up to that point paid little attention to early iterations of such listings — those were primarily circulated within higher ed institutions and associations.

Five years later, U.S. News started releasing its rankings annually, and criticism around them swelled.

Colleges did not appreciate the publication centering its methodology around such variables as a reputational survey, which today accounts for 20% of the formula. In the surveys, administrators rate each others’ colleges but often have little understanding of the intricacies of their peer institutions.

Colleges can game metrics, too. U.S. News factors in enrollees’ SAT and ACT scores, and in 2008, Baylor University reportedly dangled financial incentives for first-year students to retake the tests and potentially bolster its rankings placement. Baylor soon ended the practice.

U.S. News still backs its methodology, though. Madeline Smanik, a U.S. News spokesperson, said in an email that the publication analyzes data from surveys and “reliable third-party sources” and expects high-level officials to attest to data colleges submit directly.

“The methodology is continuously refined based on user feedback, discussions with schools and higher education experts, literature reviews, trends in its own data, availability of new data, and engaging with deans and institutional researchers at higher education conferences,” Smanik said.

Missing kindergarten teacher found dead in shallow grave close to her home

The body of a kindergarten teacher who had been missing since Monday has been found buried in a shallow grave only a few miles away from where she lived and worked, police said.To get more news about kindergarten, you can visit wikifx.com official website.

Luz Hernandez, a 33-year-old kindergarten teacher from Jersey City, New Jersey, was first reported missing on Monday which led to the Jersey City Police Department to conduct a welfare check the following day in regards to the missing person’s report, according to Hudson County Prosecutor Esther Suarez.During the course of the investigation, the Homicide Unit located what appeared to be a shallow grave in the area of Central Avenue and Third Street in Kearny,” Suarez said. “The body of a female was recovered a short time later and she was pronounced dead at the scene at 4:53 p.m.”

Authorities did not disclose the manner in which Hernandez died but said that the death is considered suspicious and the cause is currently pending upon the findings of the Regional Medical Examiner’s Office, Suarez said.Hernandez worked as a kindergarten teacher at BelovED Charter School in Jersey City -- just a two minute walk away from where she lived, according to ABC News’ New York City station WABC.

The school’s founder, Bret Schundler, called Hernandez an amazing person and a wonderful kindergarten teacher who developed close relationships with staff and students, according to WABC.

“[She was a] very pleasant woman, beautiful children. It is sad that she passed away. I feel terrible,” a neighbor identified as Monique told WABC in an interview. “She always seemed so pleasant so I really didn’t think something so severe [could happen].”

Hernandez leaves behind three young children, two of which were students at the school she taught at, according to WABC. All classes at the school were cancelled on Wednesday.

“The Hudson County Prosecutor’s Office Homicide Unit is actively investigating this case with assistance from the Jersey City Police Department and the Kearny Police Department,” said Hudson County Prosecutor Esther Suarez. “No arrests have been made at this time.”Anyone with information is asked to contact the Office of the Hudson County Prosecutor at 201-915-1345 or to leave an anonymous tip. All information will be kept confidential.

Parents of Richneck Elementary students prepare to sue

The families of two students at a Virginia elementary school where a 6-year-old shot and wounded his teacher have filed notices of potential legal action against the school system over trauma they say the shooting inflicted on their children.To get more news about elementary, you can visit wikifx.com official website.

The parents of a first-grader said their daughter was in the classroom when the shooting occurred and "suffered emotional harm as a result." The parents also alleged that school officials failed to protect their daughter throughout the school year from bullying, harassment and assault.

A letter from the other child's family cites "injuries sustained during a school shooting on January 6, 2023." Their attorney did not elaborate further, although authorities have said that no children were physically harmed during the incident.

Both notices were dated Jan. 30. Newport News Public Schools provided the letters to The Associated Press after it requested them. They were first reported by the Daily Press.The notices were the latest fallout from a shooting that has sent shockwaves through the shipbuilding city near the Chesapeake Bay and drawn mounting criticism of school administrators.

Police have said the first-grade student brought his mother's 9 mm handgun to Richneck Elementary and intentionally shot his teacher, Abby Zwerner, as she was teaching her first-grade class. Zwerner, 25, was hospitalized for nearly two weeks but is now recovering at home.

One of the legal notices was filed by "Mr. and Mrs. Anthony Nieves Jr.," and asks the school system to preserve potential evidence, including emails regarding any student who allegedly bullied, harassed or assaulted their daughter.

The parents of the other student were not named in their attorney's letter, although the notice makes a similar request for the school system to preserve evidence.

Zwerner's attorney, Diane Toscano, recently filed her own legal notice, which lays out a series of damning allegations.The document says that several hours before the shooting, at least three teachers and staff members warned school administrators that they believed the boy had brought a gun to school. The boy's backpack was searched, but no gun was found, and administrators did not remove the boy from class, lock down the school or call police.

Two days before the shooting, the boy allegedly "slammed" Zwerner's cellphone and broke it, according to her claim notice. He was given a one-day suspension, but when he returned to Zwerner's class the following day, he pulled a 9 mm handgun out of his pocket and shot her while she sat at a reading table, the notice states.

The letter from Zwerner's attorney also states that the child constantly cursed at staff and teachers, chased students around and tried to whip them with his belt and once choked another teacher "until she couldn't breathe."

In the days after the shooting, parents and teachers also lambasted school administrators for what they called a misguided emphasis on attendance over the safety of children and staff.

The Newport News School Board fired superintendent George Parker III, while Richneck assistant principal Ebony Parker resigned. Metal detectors were also put in place at Richneck, which reopened to students on Jan. 30 after being closed for a full three weeks.

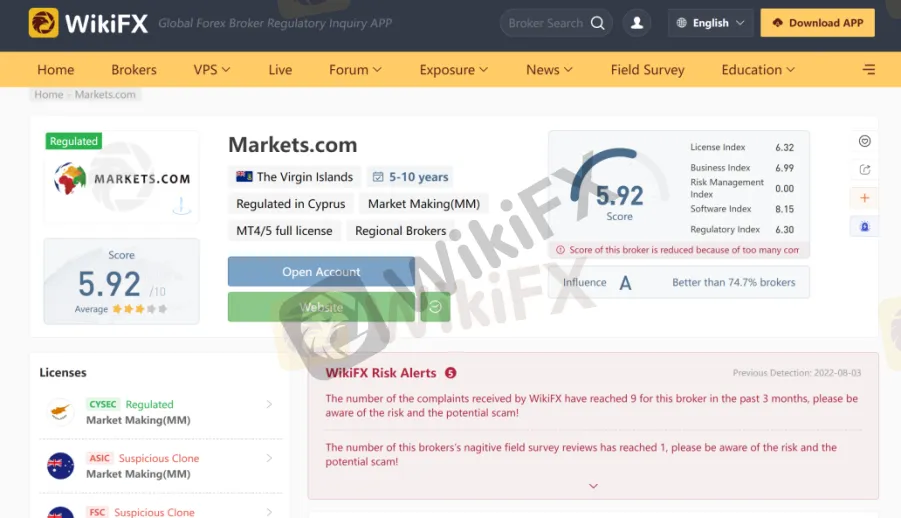

Central Margins Review – A Shady Brokerage You Should Avoid

Despite the website being inaccessible, we managed to dig up some dirt on this fraudulent broker. We believe that the website was probably taken down due to numerous complaints. But, do not count out the possibility of this scammer reemerging. That’s why the Central Margins Review is here to ensure this broker remains at the margins. To get more news about central margins review, you can visit wikifx.com official website.

On top of that, we recommend you not invest in the fake brokers FewaTrade, OpoFinance, and TargoSwiss. Do not trade with these unlicensed brokers if you want to save your money!We instantly noticed that the shady broker provided the name of its owner and HQ. The alleged owner is Central Margins Trading Services LLC, based in SVG. When scammers pick their home, they typically go for SVG because the laws there are not rigid or strict at all. However, one thing to note is that SVG’s financial regulator does not supervise Forex trading.

Furthermore, Central Margins wouldn’t be your typical scammer without including a fake address, now would it? Geneva, Switzerland, hmmm. The financial swindler really loves these tax havens.

One thing we appreciate about CentralMargins is the lucid and honest confession about its unauthorized status. The phony even put it out straightforwardly – “Central Margins Trading Services LLC is not required to hold any financial service license…” There’s not much to add here, Central Margins is unregulated as hell and pretty dangerous.

This offshore broker carefully selects its targets. From what we gathered, the main targets of this fraudster are residents of Canada, Romania, Switzerland, and the US.

Switzerland should not come as a surprise since the scammer provided a fake Swiss address. However, it’s hard to pinpoint the correlation between US/Canada and Romania. Nevertheless, wherever you come from, avoid dealing with this dangerous provider.The illicit broker claims to have won various awards, specifically for its platform, which we already covered. That’s easy to say but where exactly are those awards and who presented them? If you were to ask Central Margins that, the cat would surely run away with the scammer’s silver tongue.

Again, we did not find information about the features of the broker’s account types. What we do know is that the minimum deposit used to be $10,000. Let us spell that out for you – T-E-N T-H-O-U-S-A-N-D D-O-L-L-A-R-S! Central Margins should be ashamed! No sane provider would dare demand such a large amount of money.

Here, our scam broker claimed to accept two classic methods of payment – credit cards and wire transfers. There’s no info on fees. Hypothetically, you’ve paid the deposit through one of these two methods. In this case, you should be glad that there are ways to reverse the process but more on that later.

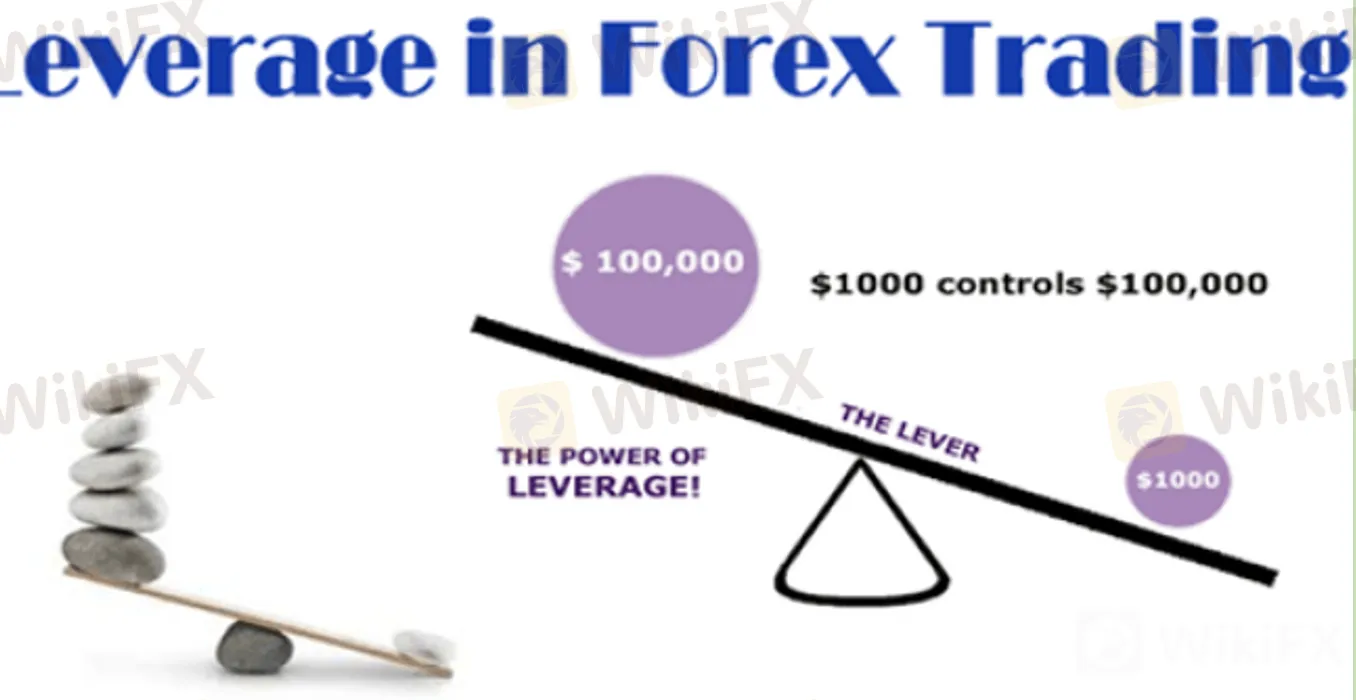

Speaking from experience, some scammers will try to lure you with either competitive spreads or high leverage or both, the latter being a double-edged sword. Central Margins allegedly offered a spread of 0.3-0.4 pips for EUR/USD, which is nice and relatively low.

But the leverage for that major pair is unknown. The only disclosed leverage is for cryptocurrencies – 1:20. For a market so volatile, this could result in huge losses, hence why regulators imposed a limit of 1:2-1:5.