User blogs

How Blockchain Technology is Changing Real Estate

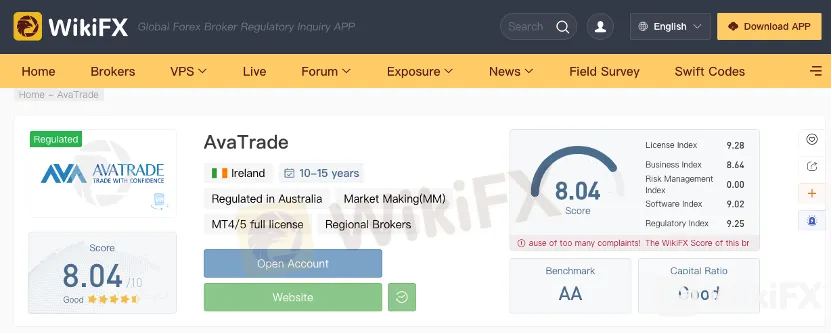

Given blockchain’s disruption of financial services and subsequent widespread application across industries, it’s hard to find a segment that has not been influenced by the technology. Cryptocurrencies have made a strong impact on payments, remittances, and foreign exchange. Initial coin offerings (ICOs) have challenged stock investing, startup loans, and venture capital. Even the food supply chain industry has been upended by blockchain.To get more news about blockchain field survey, you can visit wikifx.com official website.

Real estate hasn’t escaped blockchain disruption either. Previously, transacting high value assets such as real estate exclusively through digital channels has never been the norm. Real estate transactions are often conducted offline involving face-to-face engagements with various entities. Blockchain, however, opened up ways to change this. The introduction of smart contracts in blockchain platforms now allows assets like real estate to be tokenized and be traded like cryptocurrencies like bitcoin and ether.

1. Platforms and Marketplaces

Real estate technology has traditionally been primarily concerned with listings and with connecting buyers and sellers. However, blockchain introduces new ways to trade real estate and can enable trading platforms and online marketplaces to support real estate transactions more comprehensively. For example, ATLANT has developed a platform that uses blockchain technology to facilitate real estate and rental property transactions. By tokenizing real property, assets can then be traded much like stocks on an exchange and transactions can be done online.

ATLANT allows sellers to tokenize assets, essentially handling it like a stock sale, and liquidating that asset through a token sale using the platform. The collected tokens can be exchanged for fiat currency, with buyers owning a percentage stake of the property.

2. No Intermediaries

Brokers, lawyers, and banks have long been part of the real estate ecosystem. However, blockchain may soon usher in a shift in their roles and participation in real estate transactions, according to a report by Deloitte.

1

New platforms can eventually assume functions such as listings, payments, and legal documentation. Cutting out the intermediaries will result in buyers and sellers getting more out of their money as they save on commissions and fees charged by these intermediaries. This also makes the process much quicker as the back-and-forth between these middlemen gets cut.

3. Liquidity

Real estate has long been considered an illiquid asset since it takes time for sales to conclude. This isn’t the case with cryptocurrencies and tokens since they can, in theory, be readily traded for fiat currencies through exchanges. However, as tokens, real estate can be readily traded. A seller doesn’t have to wait for a buyer who can afford the whole property in order to get some value out of their property.

4. Fractional Ownership

By allowing fractional ownership, blockchain also lowers the barriers to real estate investing. Typically, investments would require significant money upfront in order to acquire property. Alternatively, investors with could also pool their money to acquire bigger ticket properties. Through blockchain, investors would simply have to access a trading app to buy and sell even fractions of tokens as they see fit. In addition, fractional ownership would also help them avoid managing the properties themselves such as maintenance and leasing.

5. Decentralization

Blockchain commands trust and security as a decentralized technology. Information stored in the blockchain is accessible to all peers on the network, making data transparent and immutable. One only has to go back to the housing bubble crash in 2008 to see how greed and the lack of transparency in the part of institutions can have catastrophic consequences. A decentralized exchange has trust built into the system. Since information can be verifiable to peers, buyers and sellers can have more confidence in conducting transactions. Fraud attempts would also be lessened. Smart contracts are increasingly becoming admissible records with Vermont and Arizona passing such legislation. As such, smart contracts would have more enforceability beyond the technology itself.

6. Costs

The transparency associated with a decentralized network can also trim down costs associated with real estate transactions. Beyond the savings made by cutting out intermediaries’ professional fees and commissions, there are other costs such as inspections costs, registration fees, loan fees, and taxes associated with real estate. These costs even vary depending on the territory that has jurisdiction. Like intermediaries, these can be reduced or even eliminated from the equation as platforms automate these processes and make them part of the system.

What Is the Next Big Cryptocurrency To Explode in 2023?

Cryptocurrency might have started out as a Wild West of investing dominated by mavericks, but it’s now firmly in the financial mainstream. Institutional investors and big banks treat it as a serious asset despite recent volatility, the collapse of a major exchange and regulatory crackdowns in China and elsewhere.To get more news about crypto token, you can visit wikifx.com official website.

If you need evidence of how volatile, consider this: As of March 4, bitcoin’s value has ranged from a low of $15,599.05 to a high of $45,544.36 over the past year. Despite that volatility, many cryptocurrency investors remain on the lookout for the next big payoff. Keep reading to learn which cryptocurrencies might explode soon.

Which Cryptocurrency Is Set To Explode?

If you’re looking to start buying cryptocurrency, you might be wondering which one will bring the biggest potential return. Although bitcoin might be the obvious choice, it’s not necessarily the best one in 2023. Your chances of having a big payoff might be better with a smaller coin that hasn’t already been pumped up by institutional investors the way bitcoin has.

1. Ethereum (ETH)

Ethereum, commonly known as ether, is the world’s second-largest cryptocurrency behind bitcoin, even outperforming bitcoin at times. In 2021, Ethereum instituted a major upgrade that reduced the supply of ether, currently at 120.46 million coins as of April 5. The upgrade also allowed the Ethereum network to handle more transactions per second, improve the platform’s scalability and lower transaction fees.

Compared to bitcoin, ethereum lacks scarcity — bitcoin’s supply is capped at 21 million coins — and widespread acceptance by companies and governments. However, unlike bitcoin, ethereum isn’t just a store of value. It also powers an infrastructure on which apps can be built. Other cryptocurrencies are issued on Ethereum, and it serves as the foundation of decentralized finance.

Many metaverse projects, including Star Atlas, Axie Infinity and The Sandbox, use the Ethereum blockchain, as do most NFTs. Another upgrade, this one launched in September 2022, transitioned Ethereum to a Web3-ready proof-of-stake mechanism that reduced energy consumption by about 99.95% and further increased security and scalability.

Ethereum experienced a major slump last year, losing 70% of its value between November and June, which is about on par with other major cryptocurrencies. The price is on the rise again, so this might be the right time for investors who’ve been waiting to test the cryptocurrency waters. The coin might also appeal to current investors who bought high and would benefit from dollar-cost averaging.

2. BNB (BNB)

Binance is the largest cryptocurrency exchange in terms of trading volumes. Like bitcoin, BNB coin, formerly called binance coin, keeps a hard limit on the number of tokens in circulation — in its case, 157,887,462 out of a maximum of 159,979,964 tokens are currently in circulation. This helped the token price increase exponentially in 2021.

In addition, Binance puts about one-fifth of its profits each quarter into permanently getting rid of, or “burning,” BNB tokens, which raises the value of the remaining tokens. It burned 2.06 million BNB tokens — over $575 million worth — in January and expects to eventually burn 50% of the maximum supply.

Binance has two blockchains, which reduce the kind of bottlenecks Ethereum is vulnerable to. It’s also fast and scalable, and Binance is in the process of making the platform more regulator-friendly, according to Seeking Alpha — a feature that could be crucial to its longevity and widespread adoption, especially in light of the collapse of rival exchange FTX.

3. Tether (USDT)

Tether is a type of “stablecoin” designed to provide a less volatile alternative to bitcoin because it is linked to another asset. In tether’s case, that asset is the U.S. dollar. In valuation terms, tether usually has a 1-to-1 ratio with the dollar, meaning it is less volatile than cryptos such as bitcoin and ether — “usually” being the operative word.

In May 2022, tether briefly dropped to $0.9455, its lowest price since 2018, before returning to its typical price of above 99 cents. Although analysts disagree over whether the drop constituted a true “de-pegging” from the dollar, the event led to a sell-off as investors — worried that tether would plummet like another stablecoin, terra — raced to move into bitcoin and other coins now selling at what some consider to be steep discounts.

With an $80.02 billion market cap, tether is the largest stablecoin and the third-largest coin overall. It’s also the most traded coin — cryptocurrency investors use it to hold funds or make transactions using funds they want to protect against the price swings to which bitcoin, ether and other non-stable cryptocurrencies are vulnerable. You can also lend it to cryptocurrency platforms in return for double-digit annualized interest rates without worrying too much about volatility erasing your earnings.

best crypto exchanges and apps for April 2023

When deciding on the best crypto trading platform for your needs, think about what you plan on using it for.To get more news about WikiBit, you can visit wikifx.com official website.

It’s quite common to use multiple exchanges to benefit from their different areas of specialty, such as using one for its range of coins and another for staking options. You may also want to consider whether you’re new to crypto markets or you’re a seasoned trader when selecting the platform that’s right for you.

Coinbase won the 2023 Finder Award for Best Crypto Exchange Overall because it offers a world-class service for all levels of crypto traders and investors.

If you are new to crypto, you can use the exchange to make instant purchases in just a few clicks. Seasoned crypto investors can use the platform's advanced trading option for lower trading fees, charting tools and a view of the exchange's order book.

Beyond trading, there are features such as lending, staking, Web3 access, a crypto wallet and an NFT marketplace, making the service well-rounded for most crypto needs.

Coinbase also encourages users to learn more about crypto assets and blockchain networks. In its Learning rewards section, you can watch videos that explain how digital asset networks work and then earn small amounts of the crypto assets you learn about upon correctly responding to questions about them.

Coinbase automatically rewards you with yield on any USDC held in your account. So, if you decide to park your money in stablecoins for a while, you can still increase your digital asset holdings while doing so on Coinbase.

Bitstamp won the 2023 Finder Award for Best Value Exchange because with 24/7 customer support, it provides great value for entry-level traders.

If you trade under $1,000 per month, you won't be charged any maker or taker fees for using the spot market. Fees do increase after this limit, to a moderate 0.3% and 0.4% maker-taker fee which is still competitive for traders in the US.

The exchange offers advanced charting tools, precise order execution, deep liquidity on over 80 crypto assets and top-quality APIs, which advanced traders can use to integrate their algorithmic trading strategy.

Bitstamp covers this service with 24/7 customer support that includes a phone line. This is incredibly rare for cryptocurrency exchanges, adding to its value for money service.

eToro won the 2023 Finder Award for Best Platform for Beginners because its crypto trading services are tailored toward those new to the crypto market. It received positive customer reviews as well.

The platform offers instant purchases, notable educational resources and unique trading features designed to help beginners learn to trade crypto better and benefit from the skills of more experienced traders.

If you're looking to make your first crypto purchases without having to navigate a complex trading interface, eToro makes it easy to buy digital assets in just a few clicks, which is why it also won the 2023 Finder Award for Best Instant Purchases.

The platform's beginner-level trading resource page provides short tutorials that have titles such as What is Bitcoin? and The Fed Made Simple to help prepare you to trade and invest.The mobile app provides a simple pathway to buying and selling while the desktop exchange offers reduced fees and advanced order types for traders.

features up-to-the-moment digital asset price information from CoinMarketCap, a market data website that reports price information for over 20,000 crypto assets.

Kraken won the 2023 Finder Award for Best Advanced Trading because of the array of trading services it offers through Kraken Pro, its advanced crypto trading platform.

Kraken Pro offers crypto trading vets access to margin for leveraged trading, a highly customizable trading interface and low maker and taker fees that range from 0% to 0.26%.

Kraken is one of the few crypto exchanges in the US that offers margin as well as futures contracts to traders. Please keep in mind, though, that these financial instruments are risky to trade, and they aren't designed for less-experienced traders.

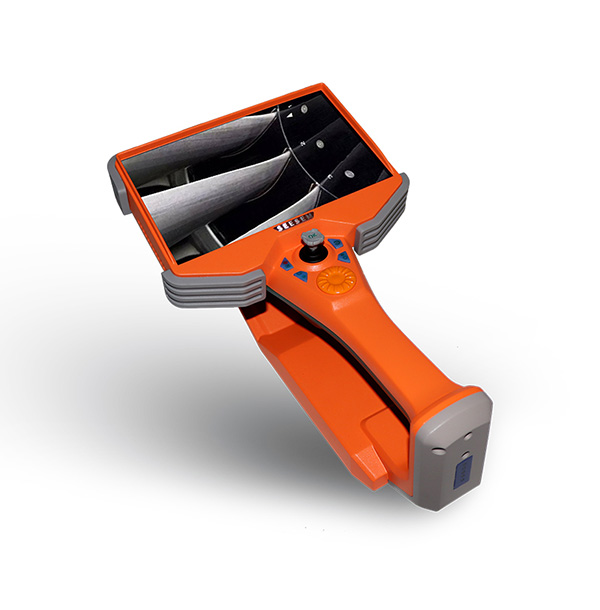

Notice Articulating Video Borescope checking

Articulating Video Borescopes are widely used in many areas, such as inspecting special equipment, aviation, pipelines, pressure vessels, automotive manufacturing, energy and other industrial fields. During an actual application, it will have to face a different test environment. Pay attention to When Using An Articulating Video Borescope?To get more news about video borescope, you can visit seesemborescopes.com official website.

1) Prohibit the use of the Articulating Video Borescope to observe the body or body of an animal;

2) Do not use the Articulating Video Borescope to inspect working equipment.

3) Do not use or store the Articulating Video Borescope on an explosive and strong electromagnetic field or with combustible gas, otherwise, it could cause a fire or explosion;

4) Not to be used for checking current objects to avoid electric shock;

5) Do not watch the LED light source at the end of the lens directly, avoiding the effect of strong light on visual acuity;

6) Never over bend, stretch, twist, wrap the cable, otherwise it may cause a circuit breaker, fire or electrical shock;

7) If there is an anomaly in the angle adjustment, stop the current operation and shut down. Then contact the supplier;

Industrial Videoscope Market Forecast to 2031

The latest market research report on the Global "Industrial Videoscope Market" is segmented by Regions, Country, Company and other Segments. The global Industrial Videoscope market is dominated by key Players, such as [Olympus, GE, Karl Storz, SKF, AIT, VIZAAR, Dellon, Yateks, Mitcorp, SENTECH, 3R] these players have adopted various strategies to increase their market penetration and strengthen their position in the industry. Stake holders and other participants in the global Industrial Videoscope market will be able to gain the upper hand by using the report as a powerful resource for their business needs.To get more news about Industrial Videoscope, you can visit seesemborescopes.com official website.

Yes. As the COVID-19 and the Russia-Ukraine war are profoundly affecting the global supply chain relationship and raw material price system, we have definitely taken them into consideration throughout the research, and in Chapters, we elaborate at full length on the impact of the pandemic and the war on the Industrial Videoscope Industry

This research report is the result of an extensive primary and secondary research effort into the Industrial Videoscope market. It provides a thorough overview of the market's current and future objectives, along with a competitive analysis of the industry, broken down by application, type and regional trends. It also provides a dashboard overview of the past and present performance of leading companies. A variety of methodologies and analyses are used in the research to ensure accurate and comprehensive information about the Industrial Videoscope Market.

With the aim of clearly revealing the competitive situation of the industry, we concretely analyze not only the leading enterprises that have a voice on a global scale, but also the regional small and medium-sized companies that play key roles and have plenty of potential growth.

A videoscope is a flexible inspection instrument that consists of a flexible insertion tube with a video display at one end and an objective lens at the other. The image is produced using a CCD camera chip 1/10th inch or smaller in diameter. The image is relayed from the inspection area to the video display electronically. An internal fiber optic light guide, or LED lighting at the objective, is used to illuminate the area being inspected. Industrial videoscopes are used for inspection of areas that are difficult or impossible to view without dis assembly or destruction of the item to be inspected.

In terms of product, Hand Held Type is the largest segment, with a share about 55%. And in terms of application, the largest application is Building And Construction Industry, followed by Aerospace, Power Engineering And Power Plants, Transport And Automotive Technology, Pipelines, Chemistry, And Plant Engineering, Building And Construction Industry, Research, Development, And Customized Solutions.

In terms of production side, this report researches the Industrial Videoscope capacity, production, growth rate, market share by manufacturers and by region (region level and country level), from 2017 to 2022, and forecast to 2028.

China’s economy might not be headed toward either ascendancy or decline

Something about China encourages grandiose predictions. Just a few years ago, the U.S. Intelligence Community forecast China would emerge from the COVID-19 pandemic economically and politically stronger than the United States.To get more China economy news, you can visit shine news official website.

Now a popular view in Washington is that China will soon pass its economic and military peak, and the U.S will confront a declining power willing to take desperate measures, especially in the event of a confrontation over Taiwan. Beijing’s military exercises following Taiwanese President Tsai Ing-wen’s visit to the U.S. this month added to this anxiety.

But China’s trajectory could look quite different from these broad predictions. The world’s second-biggest economy is probably headed neither for ascendancy nor decline, but rather for prolonged stasis. This scenario is less dramatic but still disruptive: It would alter global economic growth and could impede future responses to shared challenges like climate change. As Washington gears up for a period of greater focus on U.S.-China relations, policymakers should prepare for a China that is effectively just running in place.

China’s slowing economy feeds into the narrative of its decline. Official GDP growth has decreased almost every year since the 2008 financial crisis, and systemic issues like debt and aging limit future growth prospects. But even skeptics believe China will continue to grow in the 2020s, increasing the total size of its economy to rival that of the U.S. In the 2030s, growth is likely to be so slow that domestic incomes stagnate and China loses competitiveness compared with commercial rivals in Southeast Asia and elsewhere. Although this will have serious consequences, it’s very different than contraction.

Another related challenge is China’s aging population. Chinese data revealed the population shrank in 2022 for the first time in 60 years, after years of decline in the labor force, even as pressure on pension and healthcare systems increases with a growing number of retirees. But raising productivity through education and the adoption of new technology can help compensate for a shrinking population. And in fact, productivity trends may have improved during the pandemic.

Predictions of impending crisis also ignore the fact that Beijing has the means to tackle its most immediate economic challenges. China’s policymakers have already taken aggressive measures to deflate the real estate bubble and to contain debt accumulation. But although Beijing has been able to respond to acute economic crises in 1997, 2008 and 2020, it has punted on the structural reforms that most economists believe are necessary to prevent long-term stagnation.

The lack of reforms has caused some to predict that GDP growth will fall below 3% annually in the medium term. And hesitance to dismantle inefficient state-owned enterprises is likely to disappoint Beijing’s hopes for innovation-led growth. Other challenges like climate change impose additional drags — a severe heat wave in the summer of 2022 shaved an estimated 0.3% off already-low GDP growth.

Stagnation rather than a crash for China carries several implications for the global economy and American decision makers. China’s contribution to global growth, which may be overstated because its rising exports can depress growth elsewhere, will shrink as its export-oriented industries become less dominant. On the other hand, China’s imports may increase. These shifts will probably accelerate the diversification in global supply chains, creating a more fragmented world economy in which China will play a less central role.

A second, related implication is that Beijing may turn inward rather than lash out over Taiwan or other geopolitical flashpoints. Stagnation could make Chinese leaders less willing or able to address shared global challenges like climate change. If, as some research suggests, an older population causes innovation to slow, China may not develop the technology needed to decarbonize its exceptionally energy-intensive economy.

Faced with rising climate-related costs and slowing growth, China may be more reluctant to help other countries reduce emissions and adapt to climate risks. Tepid growth could also cause Beijing to pull back more as a partner in global governance in areas such as ensuring financial system stability or addressing future pandemics.

American policymakers tend to think about China in grandiose terms: either on its way to supremacy or collapse. They have not spent enough time pondering what it means for China to have too little impact on the world rather than too much.

East Asia and Pacific Regional Growth to Accelerate as China Rebounds

Growth in developing East Asia and the Pacific is forecast to accelerate in 2023 as China’s economy reopens, while the pace of growth in most of the economies in the rest of the region is anticipated to ease after a strong rebound last year, a World Bank report said on Thursday. To get more China finance news 2023, you can visit shine news official website.

Economic performance across the region, while robust, could be held back this year by slowing global growth, elevated commodity prices, and tightening financial conditions in response to persistent inflation, according to the World Bank’s East Asia and Pacific April 2023 Economic Update.

Growth in developing East Asia and the Pacific is forecast to accelerate to 5.1% in 2023 from 3.5% in 2022, as China’s reopening helps the economy rebound to a 5.1% pace from 3% last year. Growth in the region outside China is anticipated to moderate to 4.9% from the robust post-COVID-19 rebound of 5.8% in 2022, as inflation and elevated household debt in some countries weigh on consumption.

“Most major economies of East Asia and the Pacific have come through the difficulties of the pandemic but must now navigate a changed global landscape,” said World Bank East Asia and Pacific Vice President Manuela V. Ferro. “To regain momentum, there is work left to do to boost innovation, productivity, and to set the foundations for a greener recovery.”

Most countries in the EAP region have seen two decades of higher and more stable growth than economies in other regions. The result has been a striking decline in poverty and, in the last decade, also a decline in inequality. However, the catch-up to the per capita income levels of advanced economies has stalled in recent years as productivity growth and the pace of structural reforms has slowed. Addressing the significant “reform gap,” especially in services, could magnify the impact of the digital revolution and boost productivity in sectors from retail and finance to education and health.

The economies of the region must also cope with three important challenges as policymakers act to sustain and accelerate economic growth in the aftermath of COVID-19. Rising tensions between major trading partners will affect trade, investment, and technology flows across the region. The rapid aging of the major economies of East and Southeast Asia heralds a new set of challenges and risks with implications for economic growth, fiscal balances, and health. Finally, the region is particularly exposed to climate risks, in part due to the high density of population and economic activity along its coasts.

Air Freight From China to USA 2022: Everything You Need to Know

If you are in the market for air freight services from China to the USA, you have come to the right place. In this guide, we will walk you through everything you need to know about shipping goods by air. We'll discuss the different types of air cargo services available, as well as the pros and cons of each option. By the time you finish reading this guide, you will be able to make an informed decision about which air freight service is best for your needs. we will share : what is air shipping, air freight cost from china to usa, shipping from china to us time.Get more news about Door-to-door Air Freight From China,you can vist our website!

How long does it take to ship from china to usa by air?

Standard air freight DDP from china to the USA is usually about 8-10days; express delivery from China to the USA is about 2 -3 days.

fast air DDU/DDP from china to the USA is about 2-7days with a direct airline;

shipping from china to us by the airport to airport is about 2-5days

The restrictions related to air cargo are higher in air freight which makes this process longer and more complex. The real delivery date is based on the zip code of the destination. So, longer distances, customs clearance, and flight delays add to the delivery date. When the declaration documents are complete without any detainment risks by customs, more time is added to the transit time. When importers declare goods, one or two days are added to this time. When luggage declares goods from China, 2 or 4 days are added. In order to decrease the level of risk, the documents which are incomplete in some fields; such as the shipper's name and false declared value, should be written correctly.

Different airlines, for air freight from China to the USA, provide a variety of services based on the destination and the conditions which the importer or supplier is looking for. The table below compares some airfreight services from different cities in China to different airports in the US

Door-to-door shipping is a convenient option for those who do not have the time or means to drop off and pick up their shipments at a local shipping facility. With door-to-door shipping, your shipment will be picked up from your home or office and delivered directly to its destination. This type of shipping is often more expensive than other shipping methods, but it is worth the convenience for many people.

Honourocean can ship your shipment within 24 hours on international flights between China and major airports in usa. We have many air cargo ships that travel to these important airports: Shenzhen, Guangzhou, Shanghai, Beijing, and Hong Kong.

Five terracotta and stone facades by BKSK: Your Next Employer?

Following last week's visit to New York City-based Andrew Franz, we are keeping our Meet Your Next Employer series in New York City this week to explore the work of BKSK Architects who are currently hiring for a Project Architect.Get more news about terracotta cladding price,you can vist our website!

Founded in 1985, and directed by six partners, BKSK describes their work as "socially, contextually, and ecologically engaged." Based in New York City, the 45+ person firm has amassed a portfolio of over 200 projects across cultural, civic, educational, institutional, and residential sectors. The firm is also responsible for the design of the Queens Botanical Garden Visitor Center, the first New York City civic building to be awarded LEED Platinum certification.

Over on Archinect Jobs, the firm is currently hiring for a Project Architect to join their office located in New York City's Garment District. For candidates interested in applying for the position, or those interested in learning more about the firm's work, we have rounded up five distinctive New York City street fronts by BKSK that reflect the studio's design ethos.

For their Gatehouse to One Madison, BKSK sought to convey a "sense of arriving home" for residents. The building's five-story façade was inspired by the historically rich fabric of Madison Square at its surrounding streets, with staggered vertical fins made from custom-glazed terracotta. In addition to screening the interior spaces, the screened facade was developed to add a sense of depth to the street front.

"The variegated hues of creamy glazing imbue warmth and distinction among its limestone-faced neighbors, moving and reflecting light in unique patterns throughout the day," the team explains. "These details and others, such as the travertine forecourt that leads to the building's custom bronze and glass entrance doors, were carefully conceived to appeal to the human senses and enhance the ceremony of coming home."

A six-story commercial building on the corner of Spring Street and Broadway, BKSK developed 529 Broadway with attention given to the former Prescott House hotel that occupied the site from 1852 to 1935. Through studying both the former building and its neighbor at 101 Spring Street, the team developed a facade design that changes as it wraps around the street corner.

At the western end of its Spring Street front, the building features open-joint terracotta panels that create the appearance of punched opening masonry building. Moving east, the design evolves to reveal more of the curtain wall glass construction existing behind the terracotta system. As the building reaches its western Broadway end, the glass and aluminum curtain wall is fully expressed through protruding aluminum frames and cast iron loft proportions.

For their 12-story mixed-use residential development at 1 Great Jones Alley, BKSK once again incorporated a terracotta screen to reflect the masonry and cast-iron traditions of the site's history. To add a contemporary feel to the primary Broadway facade, the team designed an "unabashedly modern" asymmetrical form to the terracotta fins over crisp glazing.

In contrast to the historical facade along Broadway, the building's main residential entrance along Great Jones Alley employs naturally oxidizing Corten street along with a cobblestone driveway and green wall, creating an homage to the area's past "industrial grittiness." A harmony between the ornate and gritty continues inside the building through a material palette of stone, wood, ceramics, and glass.

The Reinvention of the Shear Type Coupling

Shear type or sleeve type couplings originated in the 1950s. It is a very popular choice for pump applications where it gained early acceptance and has grown organically across many industries including wastewater, paper/pulp, marine and steel to name a few.Get more news about Elastic Sleeve Pin Coupling Factory,you can vist our website!

The shear type coupling is a very simple design and is comprised of 2 flanges and 1 sleeve. The torque is transmitted through the twisting of the elastomeric sleeve and virtually eliminates the load on bearings and shafts and is excellent with vibration dampening. As with other elastomeric couplings, it is a low maintenance and non-lubricated coupling option.

Lovejoy, Inc. set a goal to redesign the sleeve coupling product and to make it the highest quality and longest lasting offering available at the same competitive price. The result is the S-Flex EnduranceTM, a new and improved, longer lasting EPDM rubber sleeve material.

The new S-Flex Endurance coupling design has undergone extensive dynamic cycling testing. The results of this testing prove the S-Flex Endurance EPDM material provides higher performance and enhanced durability than its previous iteration.

Testing was performed to determine the actual physical performance and torsional capabilities of the new EPDM sleeves. The test articles were installed between the torque actuator's driving S-Flex flange and a driven torque transducer flange. The testing regiment consisted of accelerated fatigue testing where the sleeves were subjected to high frequency start-stop-reverse cyclic loading. The sleeves completed extensive testing at loads greater than the sleeve's torsional ratings. The sleeve's performance characteristics were collected for comparison to the original material and the competitor's product. The static torsional stiffness was repeatedly measured as the slope of a stress-strain curve during dynamic cycling testing. The dynamic torsional stiffness was also continuously evaluated over the full test duration. As an additional performance guide, the competition's equivalent sleeve materials were evaluated as well.

S-Flex Endurance sleeve's static and dynamic torsional stiffness tested at least 30% greater than the former Lovejoy material and outperformed the current products in the market. The S-Flex product operated with more resilience and consequently less heat build-up. Furthermore, post-test inspections showed the new sleeves are very durable under these extreme test conditions, as they maintained their tooth shape and displayed minimal wear.

The Sleeve Life

Test Duration Graph shows that the former EPDM sleeves lasted an average of 747k cycles before reaching torque overload failure where the sleeves failed and could no longer transmit the set torque. The new EPDM material was tested for a week up to about 4.75 million cycles and no signs of failure were present at which point testing was ended. Accelerated fatigue testing is performed at severe high-torque and high-frequency conditions. Typical operation cycle life will greatly exceed the test cycles in the graph. The cyclic fatigue test conditions demonstrate the new EPDM material has at least a 3X longer life expectancy, if not more, than the former material.