User blogs

Taste evaluation of the popular wdg milk tea cup recently: 1. Iced mineral water: this taste is a little bit of mint flavor, but it is cooler and cooler, with a moderate degree of coolness and a moderate degree of sweetness. The color of the cup is basically no color difference,

2. Coconut green: This flavor has a medium concentration, a light coconut flavor, and a moderate coolness. This one is not so sweet, and the sweetness is a little low,

3. Jasmine Longjing: The combination of jasmine and Longjin tea, the faint taste of jasmine, and the tea fragrance of West Lake Longjing tea, are very good to drink, with medium and high concentration, low cooling, and just good taste,

4. Lemongrass, the fragrance of lemon, combined with the clear taste of green grass in the mouth, has a moderate intensity, a moderate coolness, and a moderate sweetness. Friends who like light taste can choose this taste.

5.Taro ice cream: Taro and ice cream are perfectly combined. The taste of taro is in the mouth, and the sweet smell of ice cream is in the throat and out of the nose. It is really super easy to draw. The color of the cup is the same. Girls like it best. The taste is medium and above, cool and sweet

Where can rxs milk tea cup cigarette bombs be wholesale? Refer to three major channels 2023

RXS milk tea cup mini version official website price: 129 yuan, contact the merchant?? How about the RXS milk tea cup? "If you just want to buy one for yourself, you can buy it on WeChat and Taobao, because the round-trip cost is generally not cheap." 22 yuan, the RXS milk tea cup is in the regular channel at one time, and the [strongest one-time] comprehensive evaluation of RXS milk tea cup completely surpasses the Yueke egg-changing style and falls off the altar! [Vendors in the delivery channel v192962596]

RXS milk tea cup source, RXS milk tea cup agent, revealing RXS milk tea cup channel, RXS milk tea cup investment has been updated

The official claim of this product is 10000, and the capacity of tobacco oil is 16ml, but the RXS milk tea cup with the same 16ml tobacco oil is only 2200, so you can measure it yourself. The blogger recommends several good flavors to you.

Peach soda taste:

It's really like eating a peach. The taste is the same as the oil of RXS peach soda. It is also very reductive. It's a little sweet, so people who don't like it may not like it. Ice mineral water taste:

This is one of the main flavors of RXS milk tea cup. It smells light, like an old popsicle. It feels like drinking a mouthful of mountain spring water, and then a little sweet. The taste is very good. I highly recommend it.

Try it, friend.

Coconut flavor:

This taste is really good.

The taste of coconut water is very reductive, especially the first taste is amazing, and it is also very popular.

Lemongrass flavor:

This flavor is my favorite flavor. It is much better to suck than to beat lemon with Yueke's hand. The first entrance is the fragrance of lemon, which is very refreshing. I strongly recommend this taste

The Lamplighters by Emma Stonex review – a superb debut

On New Year’s Eve 1972, a boat arrives at the Maiden Rock lighthouse, 15 nautical miles southwest of Land’s End, to relieve assistant keeper and family man Bill Walker from a two-month tour of duty. But Walker, principal keeper Arthur Black and their junior Vincent Bourne have all disappeared without trace, leaving the door barred, the table laid and the clocks stopped at a quarter to nine. Twenty years later, in an attempt to solve the stubborn mystery, a young writer of maritime adventure stories comes to interview the women the lighthousemen left behind – and thus is launched Emma Stonex’s superbly accomplished debut novel The Lamplighters.To get more news about stonex review, you can visit wikifx.com official website.

Proud and pragmatic Helen, jumpy, depressed homebody Jenny and harried mother Michelle have kept each other at a prickly distance over the intervening years. Each defends her husband’s reputation and has her own reasons for keeping silent. Interweaving the individual stories of the men’s last days on the rock with the women’s accounts of their lives then, now and in between, the immaculately paced narrative circles the central awful truth inside the abandoned lighthouse.

Inspired by the mysterious disappearance of three lighthouse keepers off the Hebrides in 1900, The Lamplighters is a whodunnit, horror novel, ghost story and fantastically gripping psychological investigation rolled into one. It is also a pitch-perfect piece of writing. As it threads together the inner lives of the men and women and gradually exposes their secret torments, the novel sets the intense and dangerous lyricism of the lighthouse’s heightened world against the banal, fretful prose of life on shore, with dinners spoiled and children crying. The descriptions of the damp, briny, windowless interior of the Maiden, the shifting seas, the choking fogs and sudden, unnatural sounds, are simply breathtaking; and, like all the best literary writing, they don’t halt the action, they lift and propel it. Stonex evokes increasing madness in a confined space with subtle intelligence, but she never loses track of the numbing grimness of the everyday, and what it takes to keep going under intolerable pressures.

As with Shirley Jackson’s work or Sarah Waters’s masterpiece Affinity, in Stonex’s hands the unspoken, unexamined, unseen world we can call the supernatural, a world fed by repression and lies, becomes terrifyingly tangible. It brushes against us as we sleep, more real than home, more dangerous than the gun in the drawer.

I hope you appreciated this article. Before you move on, I was hoping you would consider taking the step of supporting the Guardian’s journalism.

From Elon Musk to Rupert Murdoch, a small number of billionaire owners have a powerful hold on so much of the information that reaches the public about what’s happening in the world. The Guardian is different. We have no billionaire owner or shareholders to consider. Our journalism is produced to serve the public interest – not profit motives.

And we avoid the trap that befalls much US media – the tendency, born of a desire to please all sides, to engage in false equivalence in the name of neutrality. While fairness guides everything we do, we know there is a right and a wrong position in the fight against racism and for reproductive justice. When we report on issues like the climate crisis, we’re not afraid to name who is responsible. And as a global news organization, we’re able to provide a fresh, outsider perspective on US politics – one so often missing from the insular American media bubble.

Around the world, readers can access the Guardian’s paywall-free journalism because of our unique reader-supported model. That’s because of people like you. Our readers keep us independent, beholden to no outside influence and accessible to everyone – whether they can afford to pay for news, or not.

Quotex Review

This article will examine in detail the Quotex online brokerage platform, which is growing in popularity. Is it safe and reliable? What are the features and tools of this trading platform ? These questions will be answered and we will give our opinion about this broker.To get more news about quotex review, you can visit wikifx.com official website.

What is Quotex?

Quotex is a digital options broker that lets you invest in over 400 assets like forex currency pairs, stocks, commodities and cryptocurrencies. This broker started its activity in 2019 under the company name of Awesomo Limited. Currently, it operat under the corporat name of Maxbit LLC, incorporated into the first floor, First St Vincent Bank LTD Building James Street, Kingstown St. Vincent and the Grenadine.

This broker started providing these online brokerage services in 2019. Quotex.io mainly aims to provide a simple and enjoyable trading experience. It is a recognized, award-winning, transparent and intuitive digital option trading platform that has been developed by developers with over 10 years of experience.

Trading Instruments

Quotex offers these clients the opportunity to trade on more than 400 Assets to allow both beginners and professionals to trade in the financial markets. With this broker you can trade stocks, forex currency pairs, metals, oil and gas and cryptocurrency trading. This binary options broker allows you to obtain a return on investment of up to 98% on a wide variety of assets.

Quotex allows you to speculate via digital options ranging in duration from 1 minute to 4 hours. You can also earn investment profits up to 98% of your investment if invested correctly. Just like most binary options brokers, you can start trading with minimum investment sizes of just $1. This minimum investment sum is suitable for the vast majority of traders.

Trading platform

On the trading platform side, Quotex allows you to trade many underlying assets via this online trading platform. At this broker, digital options refer to binary Up/Down options, offering fixed profit or loss based on upward or downward price movements for each investment.

Quotex.io is a completely web-based online trading platform and you don’t need any software like Metatrader 4 or any other trading platform to trade. Simply connect to it from any device with a web browser, such as a computer, smartphone or tablet.

Quotex is designed to be an easy to use, intuitive platform and offers many indicator options like Bollinger Bands, Ichimoku Cloud and over 9 other trend indicators are available. This broker also puts at your disposal 15 oscillators such as MACD or RSI.

Demo account

Like most serious brokers, Quotex offers the possibility to test the platform and trade risk-free before starting to trade in real money.

Demo accounts are a great way to get started in trading, especially for beginners. Professional traders can also take advantage of it to improve their trading skills or test trading strategies without the associated risk.

The quotex demo account is completely free and offers up to $10,000 in virtual balance. The demo account can be recharged at any time. You can then switch between demo and real accounts by simply clicking on the menu.

For those who want to know more about the trading platform and its features, it is recommended to start with a free demo account. Then when you feel ready to trade in real money you can start trading with a deposit of just $10.

NovaTech FX Ponzi scheme collapses, withdrawals disabled

The NovaTech FX Ponzi scheme has collapsed.To get more news about novatech review, you can visit wikifx.com official website.

In a communication sent out to investors on February 5th, “NovaTech Admin” advised withdrawals have been disabled.

I’ll spare you the excuses NovaTech FX preambled their collapse confirmation with. If you want to the read the full thing I’ll include it at the end of this article.

Rather than just admit NovaTech FX is a Ponzi scheme in which withdrawals inevitably exceeded new investment, NovaTech FX’s exit-scam buys them 60 days.

For those unfamiliar with NovaTech FX, “trading account” refers to ROI payments. “Bonus account” refers to commissions earned by recruiting new victims into the scam.

When a Ponzi scheme initiates a time-delayed exit-scam, there are typically two goals in mind:

create as much distance between the admin of the Ponzi scheme and their victims and

hold off the inevitable flood of complaints to financial regulators for as long as possible.

To that end NovaTech FX is dangling a “numbers on a screen” carrot to get people to cancel pending withdrawal requests (some of which are backdated to early December 2022).

This will of course only exponentially grow NovaTech FX’s withdrawal deficit, as whatever new money was flowing in is sure to drop to almost nothing now that withdrawals are disabled.

This isn’t specific to NovaTech FX, it happens when every Ponzi scheme initiates an exit-scam.

NovaTech FX’s collapse follows co-founder and CEO Cynthia Petion appearing on a corporate webinar last week. In the webinar Petion reassured NovaTech investors everything was fine.

At the time Petion blamed NovaTech FX’s withdrawal issues on payment processor problems. This ruse started last October but seems to have worn thin as the months dragged on.

NovaTech FX’s collapse also follows multiple regulatory warnings across the US, Russia and Canada (Ontario, Alberta, British Columbia and Saskatchewan).

Throughout 2022 the majority of NovaTech FX’s website traffic originated from the US. Cynthia and Eddy Petion are also US nationals.

ForexMart Review 2023

ForexMart offers the MT4 desktop, mobile and web terminal on several competitive accounts. If you want to login and trade with ForexMart, our broker review explores the key features, including leverage, minimum deposits and bonus deals. We’ll also cover regulations and security, to help you determine if ForexMart is safe or a scam.To get more news about forexmart review, you can visit wikifx.com official website.

ForexMart Headlines

ForexMart is a brand name of Instant Trading EU Limited, a forex and CFD broker based in Cyprus. The company has been in operation since 2015 and holds a CIF license with the Cyprus Securities and Exchange Commission (CySEC). ForexMart also holds a sponsorship deal with HKM Zvolen, a Slovakian ice hockey team.

In addition to building its reputation, ForexMart is committed to providing a secure and competitive service to clients. Users can trade on currency pairs, indices, shares, commodities and cryptocurrencies, with access to award-winning software and daily market analysis.

MT4 Trading Platform

ForexMart offers the renowned MetaTrader 4 (MT4) platform, a powerful and user-friendly trading tool used by millions worldwide. The system allows traders to track several charts simultaneously, trade directly from the chart and manage multiple orders. Features include:

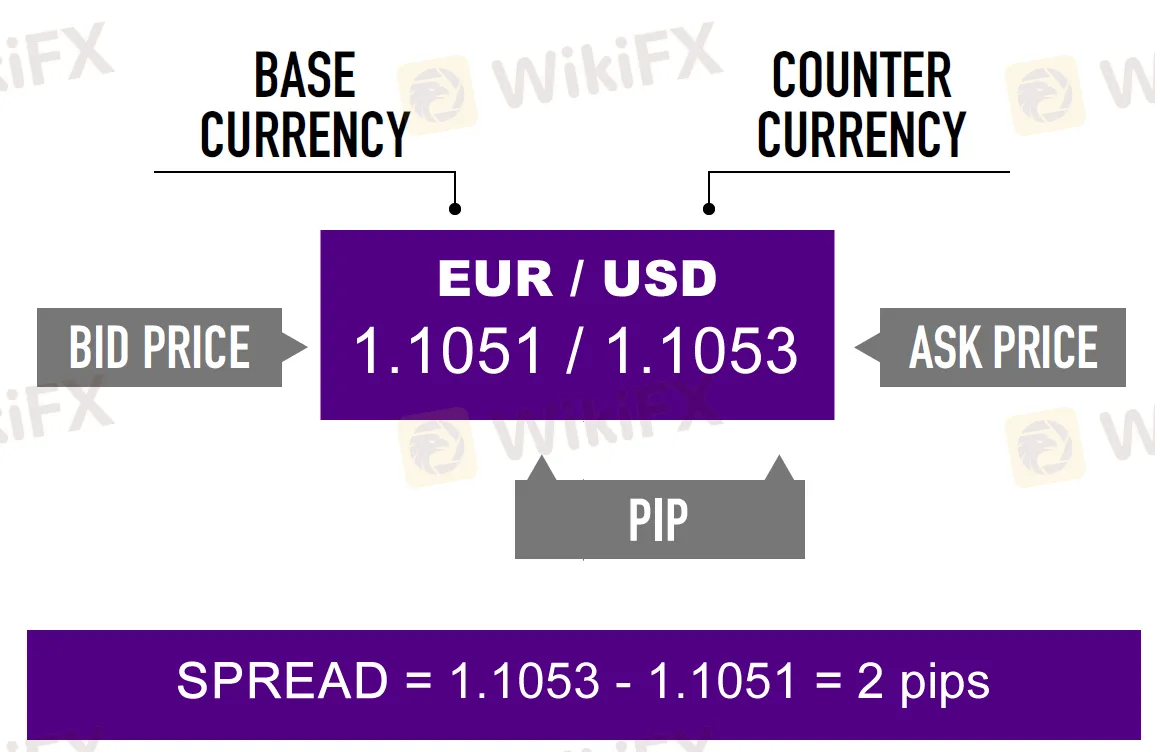

Spreads & Commission

Pricing varies depending on what instrument you are trading and is determined by the six different account types on offer. Floating spreads in the Classic account are around 1.2 pips for major forex pairs such as EUR/USD, whilst Pro account spreads average around 0.8 pips for the same pair.

Commission-free trading is also available on forex but the Zero Spread account charges between 0.02% and 0.07%. There is also a 0.10% commission on CFD shares and cryptocurrencies, a $10 fee per lot on indices and $40 per lot on energies.

Leverage

The maximum leverage available at ForexMart EU is 1:30 on major forex pairs. FX minors, indices and spot metals are available up to 1:20, energies up to 1:10, CFD shares up to 1:5 and cryptocurrencies up to 1:2. Non-EU clients can leverage up to 1:500.

Mobile Trading

ForexMart delivers the MT4 mobile app for Android and iPhone users. As with the online desktop platform, the mobile cabinet boasts some impressive features, including real-time quotes, technical analysis tools, financial news and a full set of trade orders. The advanced functionality also allows users to customise and configure their charts in just a few taps.

Deposits

ForexMart offers a good range of deposit methods, including cards, bank transfer, e-wallets and Bitcoin deposits. Note that some payment systems may be unavailable in certain regions. Most methods are processed either instantly or within 24 hours and ForexMart does not charge any deposit fees. PayPal is not available.

The online brokers offers a competitive minimum deposit of just 1 Euro / US Dollar, making it a good option for beginners.

Withdrawals

Most of the same methods are available for withdrawals and are usually processed within 24 hours. ForexMart does charge withdrawal fees, however. Card withdrawal fees are 1.8% + 0.05 EUR, Skrill and B2B Pay are charged from 1%, Sofort and bank wire from a minimum of 5 EUR and Neteller from 1 USD.

Demo Account

ForexMart offers a demo account where you can trade with up to a $500,000 virtual balance. The demo account is ideal for new or experienced traders who want to learn FX trading or improve skills in a risk-free environment.

ForexMart Bonuses

As per strict regulations around trading bonuses in the EU, ForexMart does not offer any deals at this time. This includes any no deposit bonus deals, welcome bonus promotions or demo contest opportunities.

You may find the occasional offer on the non-EU site, however, including a 30% welcome bonus. Make sure to check the bonus terms and conditions for details.

Regulation Review

Instant Trading EU Ltd is a Cyprus Investment Firm (CIF), regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 266/15. CySEC ensures that CIF firms follow strict financial guidelines in accordance with EU law, including client money protection through the Investor Compensation Fund. ForexMart also offers negative balance protection.

Note, the non-EU website accepts traders from around the world, including Canada, Indonesia and Malaysia, but regulatory protection is limited.

FxView Review 2023: Is this Online Brokerage Worth it?

You’ve been searching for the perfect online brokerage forever. You’ve read countless reviews and scoured the internet for information, but nothing seems to be the right fit.To get more news about fxview review, you can visit wikifx.com official website.

You’re starting to feel frustrated and hopeless. That is until you come across a review about FxView. As you read through, you start to get a glimmer of hope. Could this be the solution you’ve been searching for?

In this FxView Review, you’ll be taken on a journey of discovery as I uncover everything you need to know about this platform. From its features to its fees and everything in between, I’ll leave no stone unturned.

What is FxView?

As an online brokerage, FxView Europe was established in the year 2017. It is owned and operated by Charlgate Ltd, headquartered in Limassol, Cyprus, and regulated by the Cyprus Securities and Exchange Commission (CySEC).

FxView Global (Charlgate SVG LLC) is also registered in St. Vincent and the Grenadines. In June 2021, the broker was acquired by Finvasia Group.

As a European broker, FxView specializes in trading Contracts for Difference (CFDs) in the forex, stock, cryptocurrency (for global clients only), commodity, and indices markets.You can expect a top-notch trading experience with the broker, including quick trade execution speeds, low spreads, one-click trading, and a 100% deposit bonus (deposit match).

Features of FxView

It’s essential to understand the different features a broker offers to decide whether it meets your trading activity.In this section, we’ll take a closer look at the various features of FxView and how they can benefit you as a trader.

Multiple Trading Platforms

FxView offers traders the flexibility to execute trades from three supported platforms – MetaTrader 5, ActTrader, and ZuluTrade. This allows you to choose a platform that suits your preferred desktop, browser, or mobile experience.

Demo Accounts

If you are not yet ready to trade with real money, FxView offers unlimited use of demo accounts. This is an opportunity to familiarize yourself with the various analytical tools and trading instruments available without any real risk involved.

100% Deposit Bonus

For traders willing to start trading with real money, FxView offers a 100% deposit bonus. This means the company will match 100% of your deposit, allowing you to trade with more funds.

How Much Does FxView Cost?

As a trader using FxView, you can expect transparent and straightforward costs. The platform itself does not charge any fees, including an inactivity fee. However, there is one exception: a commission fee of $1,000 per month for automated API trading.

You should be aware that additional charges may come from sources other than the platform. For example, you may be charged a commission of $1/$100,000 for each trade.

Your bank may also charge a fee when you make a payment. Nonetheless, these charges are usually minimal and will not significantly impact your overall profits.

FxView Deposit and Withdrawals

When making deposits and withdrawals with FxView, you can rest assured that there are no additional charges for these transactions. However, it is essential to keep in mind that there are minimum deposit requirements.

If you are a trader based in the EU, you must deposit at least $200, while global traders must deposit a minimum of $50.For withdrawals, the minimum amount is roughly $15. Please note that this amount may fluctuate slightly due to currency conversion.

FxView offers a variety of methods for making deposits and withdrawals, including bank transfers, credit/debit cards, cryptocurrency, Skrill, and Neteller. Additional deposit methods may also be available.

Admirals Review

Admirals has been around for nearly twenty years. This broker offers high-tech software tools for its clients, including MetaTrader 4 and MetaTrader 5, as well as a proprietary plug-in called MetaTrader Supreme Edition. Admirals has a lot to offer, education- and analytics-wise. Tutorials, webinars, seminars, and videos are free to use, and they all thoroughly break down different trading definitions, concepts, and strategies.To get more news about admiral markets review, you can visit wikifx.com official website.

Admirals has competitive spreads and low commissions. It offers a wide range of accounts based on the software you choose. Admirals provides more account flexibility than you might see with other brokers. Investment firms under the AdmiralsTM offer trading in Forex and CFDs on a variety of products, including energies, stocks, bonds, ETFs, indices, and metals. If you’re looking for a reliable, feature-heavy broker, Admirals is a wise choice.

Who Is Admirals Recommended For?

Judging from the educational tools offered, Admirals can work with any level of trader, from a total trading newbie to an old pro. Admiral’s “Zero to Hero” course teaches new traders about the market, showing them the ins and outs of trading Forex from the very beginning. Offerings like “Zero to Hero” indicate that Admirals is willing to help out novices.

Experienced traders also will like this broker, as it offers advanced software systems with which professionals will no doubt be familiar. Admirals offers MT4 and MT5, both of which have become industry standards in software. All in all, don’t let experience level get in the way of checking out this broker, as Admirals has something for everyone.

Regulatory Authorization and License. As you can see from the below, this broker is heavily regulated. Admirals has been around for nearly two decades, developing a global reputation. Though trading is far from a sure thing, regulation is an important stepping-stone for reliability.

Advanced Trading Tools. Admirals offers advanced tools that you can’t find anywhere else, particularly when it comes to its MetaTrader Supreme Edition. This plug-in was created by Admirals for MetaTrader 4 and 5. It contains over fifty extra features that you can’t get with the 4 or 5 platforms.

Flexible Trading Accounts. There are a lot of trading accounts available with Admirals (discussed in the tables below), and these accounts allow for a lot of flexibility. Your account preference will be based on whether you use MetaTrader 4 or MetaTrader 5. MT4 users can pick from Zero.MT4 and Trade.MT4 (the latter of which is the most popular). MT5 users can pick from Zero.MT5, Invest.MT5, and Trade.MT5. For MT5 users, Trade.MT5 is the most popular.

Low Spreads. Admirals offers low spreads, which vary based on your account. MT5 account holders will see spreads starting from 0-0.5, same with MT4 account holders. Such low spreads are one of the most valuable aspects of this broker, particularly for traders who plan to be very active.

Low Commissions. Commissions fees are low with this broker, which every trader can appreciate. At Admirals, commissions vary based on the market. MT4 account holders will find that some instruments have zero commissions, while others are $0.02 per share or $1.80-$3.80 per 1.0 lots. MT5 account holders will see similar commissions. For more information on commissions, check out our table below. Helpfully, Admirals also has a transparent table detailing its commissions on its website.

Admirals Compliance & Regulation

Regulation wise, Admirals has quite a few bodies overlooking it. These include The Financial Conduct Authority (United Kingdom), Cyprus Securities and Exchange Commission (Cyprus), Financial Supervision Authority (Estonia), Australian Securities and Investments Commission (Australia), Companies and Intellectual Property Commission (South Africa) and Jordan Securities Commission (Jordan).

Admirals Pricing

When it comes to fees, Admirals has an entire page dedicated to transparently revealing the way they charge (or don’t charge) you for various payment methods’ deposits and withdrawals. This broker’s commissions are included in its contract specifications, and these commissions vary based on the market.

Internally, if you’re transferring funds from separate Admirals trading accounts, you’ll find that it is free to transfer if the accounts have the same base currency. If they are different, the fee totals 1% of the transfer amount. Between separate wallets and trading accounts, there are ten free transfers and then a 1% fee is charged if the currencies are different.

It is free to open a live demo or trading account at Admirals. Note that there is an inactivity fee that has been around since January 9, 2017. The inactivity fee is 10EUR per month. Trading accounts that haven’t executed transactions in two years (and haven’t been used to hold positions) will incur the 10EUR monthly fee.

Pepperstone Review

According to this broker, the story behind the founding of Pepperstone had to do with the founders’ desire to make trading easier. Pepperstone was founded in 2010, and its goal is to provide good customer support, low-cost spreads, and high-tech features. To get more news about pepperstone review, you can visit wikifx.com official website.

Pepperstone has two account offerings: Razor and Standard. Each has slightly different conditions, and they’re geared towards scalpers or new traders, respectively. Other high points of this broker include the competitive spreads and multiple platforms available (including MetaTrader). Read through to see what else Pepperstone has to offer interested clients.

Who Is Pepperstone Recommended For?

According to Pepperstone, it is suitable for traders of all experience levels—and its account selections reflect that. The Standard Account is best for new traders who want a simple experience, with commissions already built into the spread. By contrast, the Razor account is best for more experienced traders and scalpers. There is also a wide selection of educational tools on the site, which seems to indicate that Pepperstone is fine with novices using its services.

Trading Platforms

MetaTrader 4 - the most popular of the MetaTrader suite, which has become standard for traders over the past few decades. With MT4, you can customize the way you trade, build and run expert advisors with MQL4, ID high-probability trades using Autochartist, and access twenty-eight indicators and EAs using MT4’s Smart Trader suite.

MetaTrader 5 - as you may have guessed from the name, is the more advanced version of MT4. It is the more powerful release of the platform, and there are all of the features from MT4 with greater functionality. You can code easily, and there is faster processing and advanced customization.

CTrader - replicates the institutional trading environment. Pepperstone says it is perfect for people who are just getting started with trading. You can access FIX API, code with cTrader Automate, and control order fills and slippage with the platform’s advanced features. All three of these platforms, MetaTraders 4 and 5 and cTrader, are available with Pepperstone.

Pepperstone Compliance & Regulation

Regulatory bodies governing Pepperstone include: the Financial Conduct Authority (United Kingdom), Cyprus Securities and Exchange Commission (Cyprus), Federal Financial Supervisory Authority (Germany), Australian Securities and Investments Commission (Australia), Dubai Financial Services Authority (United Arab Emirates), and SCB (The Securities Commission of The Bahamas, (SIA-F217).

Pepperstone Pricing

When it comes to spreads, commissions, and swaps, Pepperstone uses various liquidity providers from Tier 1 banks and other institutions to help keep quotes competitive. Depending on what account you have with Pepperstone, your spreads could start as low as 0.0. There are only commissions when you have a Razor account and are trading CFDs on shares and forex. If you’re using MT5 or MT4, micro-lots are rounded down or up.

The swap rate, which is a rollover interest rate charged when you hold positions overnight, is released weekly by institutions that Pepperstone works with. These rates are calculated based on market conditions and risk management analysis. You can find this broker’s swap rates posted on the trading platforms, though the rates are subject to change, based on how volatile the market is.

Pepperstone Reliability & Security

Judging from the platforms offered, Pepperstone provides its traders with a reliable experience. The MetaTrader suite is a good sign of reliability, as it has become an industry standard over the years. Additionally, Pepperstone’s customer service is top-notch and available with extensive hours, so reliability issues that might pop up can be addressed quickly.

Vantage Review

Vantage rounds out its MetaTrader platform suite offering with support for multiple social trading platforms, content powered by Trading Central and a proprietary mobile app. However, Vantage trails industry leaders in key areas such as research and education.To get more news about vantage review, you can visit wikifx.com official website.

The range of available markets at Vantage will depend on which entity regulates your account. The following table summarizes the different investment products available to Vantage clients.

Cryptocurrency: Cryptocurrency trading is available at Vantage through CFDs and through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

Trading costs at Vantage depend on which account you open and on which specific Vantage entity holds your account. There are three account options at Vantage: the spread-only Standard STP account, and the commission-based RAW ECN and PRO ECN accounts. Overall, Vantage’s pricing falls mostly in line with the industry average, but can’t compete with pricing leaders Saxo Bank, IG, and CMC Markets.

Standard vs. Raw accounts comparison: Vantage lists typical spreads of 1.22 pips on the EUR/USD (for the month of August 2021) for its spread-only Standard account. For its Raw account, average spreads are 0.15 pips with a commission of $3 added per side ($6 per round turn), totaling 0.75 pips during the same time period.

PRO account: The PRO account from Vantage has competitive pricing, with its per-side commission amounting to just $2 (or $4 per round turn). Requirements for opening a PRO ECN account with Vantage fluctuate between its regulating entities. Its Australian entity requires that you qualify to be categorized as a wholesale client. If you open your account under Vantage’s Cayman Islands entity, you must fund your account with at least $20,000. For those who can meet its various account requirements, the PRO ECN account is Vantage’s best-priced option, and is comparable to similar accounts offered by FP Markets and Tickmill.

Active traders: The active trader program from Vantage offers rebates ranging from $2 to as much as $8 per standard lot, depending on your balance and monthly volume. The smallest tier starts at $10,000 and the highest tier requires at least $300,000 in equity. However, it is only available on the Standard account, which has the highest spreads from among all the account options available.

Mobile trading apps

Vantage offers its own proprietary trading app, alongside the standard MetaTrader suite of mobile apps. Vantage has built a decent foundation for a new mobile trading application with its Vantage App. However, I am not a fan of the ads, and it is still a long way off from being able to compete with the mobile apps that are offered by IG, FOREX.com, and Saxo Bank.

Apps overview: Vantage offers two mobile apps: its proprietary Vantage App, and the MetaTrader platform suite. The MetaTrader 4 (MT4), MetaTrader 5 (MT5), and Vantage mobile app come standard from their developer for iOS on Apple App Store and for Android on Google Play.

Ease of use: I found the advertisements within the Vantage app to be a distraction from the trading experience. I'd prefer to avoid ads and promotional content when using a mobile trading app. That being said, Vantage has done a good job of integrating research, with newsletter updates, signals, and multiple Trading Central-powered videos per day.

Charting: Charting at Vantage allows for only five time frames, one chart type, and just a handful of indicators and overlays. On the plus side, tapping on the chart launches it into a full-screen landscape view, which is a nice touch. In contrast, charting from Plus500 comes with over 100 indicators and allows for the ability to use multiple indicators at the same time.